Australia’s Trusted Mortgage Experts — Making Property Simple & Strategic

Whether you're buying, investing, or refinancing — we’ve got your back.

Trusted by Thousands, Recognised by Industry Leaders

Trusted by Thousands, Recognised by Industry Leaders

Award-winning service, 130+ 5-star reviews, and partnerships with Australia’s top lenders.

A Loan for Every Stage of Life

We specialise in a wide range of lending solutions tailored to your unique goals.

First Home Buyer Loans

Get your dream home with expert guidance and minimal stress.

Investment Property Loans

Build wealth with the right structure and strategy.

Refinance & Debt Consolidation

Lower your rates, reduce repayments, or access equity.

Business & SMSF Lending

Smart lending options for self-employed, trusts, and SMSFs.

Car & Equipment Loans

Whether it’s a new vehicle or essential equipment, we offer flexible loan options to suit your needs.

The Go-To Team for Ambitious Australians We don’t just get you a loan — we help you build a future.

Our purpose is to educate and empower you to make informed financial decisions, tailored to your immediate and ongoing financial goals.

1. Personalized financial solutions

2. Education as well as advice

3. Language you can understand

4. More lenders means more choice

Facts about us

Our Commitment to you

At ASK Financials, we believe finance should feel empowering — not overwhelming. Our commitment is to be in your corner at every step, helping you make confident decisions and build long-term financial freedom

Personalised Advice That Puts You First

We take the time to understand your goals and tailor solutions that suit your unique situation — no cookie-cutter loans here.

Fast, Transparent, and Hassle-Free Process

We simplify the loan journey with clear communication, fast approvals, and end-to-end support — so you're never left guessing.

Annual Reviews to Keep You on Track

Your needs evolve, and so should your loan. We check in annually to ensure your structure still works for you.

Access to Over 45+ Lenders

We partner with Australia’s top banks and lenders, giving you access to competitive rates and exclusive loan products.

We are members of AFCA & FBAA

Expert Advisors with 10+ Years of Experience

Our team has over a decade of experience in the financial industry, ensuring you receive expert advice tailored to your needs.

500+ Clients Successfully Secured Loans

We’ve helped hundreds of clients navigate the loan process and secure the best options for their financial goals.

Trusted by Australia’s Leading Lenders

We work with top-tier lenders across Australia, offering you access to the best loan products available.

Certified & Accredited

We are members of AFCA (Australian Financial Complaints Authority) and MFAA (Mortgage & Finance Association of Australia.

We are members of AFCA & FBAA

Expert Advisors with 10+ Years of Experience

Our team has over a decade of experience in the financial industry, ensuring you receive expert advice tailored to your needs.

500+ Clients Successfully Secured Loans

We’ve helped hundreds of clients navigate the loan process and secure the best options for their financial goals.

Trusted by Australia’s Leading Lenders

We work with top-tier lenders across Australia, offering you access to the best loan products available.

Certified & Accredited

We are members of AFCA (Australian Financial Complaints Authority) and MFAA (Mortgage & Finance Association of Australia.

Expert Financial Services,

Made Simple

Expert Financial Services,

Made Simple

Meet the Experts Behind Your Financial Success

Our dedicated team of finance professionals is here to guide you every step of the way. With years of experience and personalized advice, we turn your goals into achievable results.

Our dedicated team of finance professionals is here to guide you every step of the way. With years of experience and personalized advice, we turn your goals into achievable results.

Amol Khuntale

ASK Financials is built on one core belief — every Australian deserves clarity, confidence, and a real strategy when it comes to property and finance.

Led by multi-award-winning broker Amol Khuntale, we combine deep expertise with innovation to help clients make smarter moves — whether it’s buying a first home, growing an investment portfolio, refinancing for better savings, or securing business and asset finance.

Our approach is different.

We don’t just process loans — we build long-term partnerships.

We give straight answers, fast turnaround, and a transparent process backed by a dedicated credit team.

With a strong track record across Australia and recognition from the FBAA, AFG, MPA, and major industry awards, ASK Financials has become one of the country’s most trusted names in strategic property finance.

From your first purchase to your long-term wealth plan, we’re here to guide the journey — with clarity, care, and a commitment to results.

ASK Financials — smarter finance decisions, stronger financial futures.

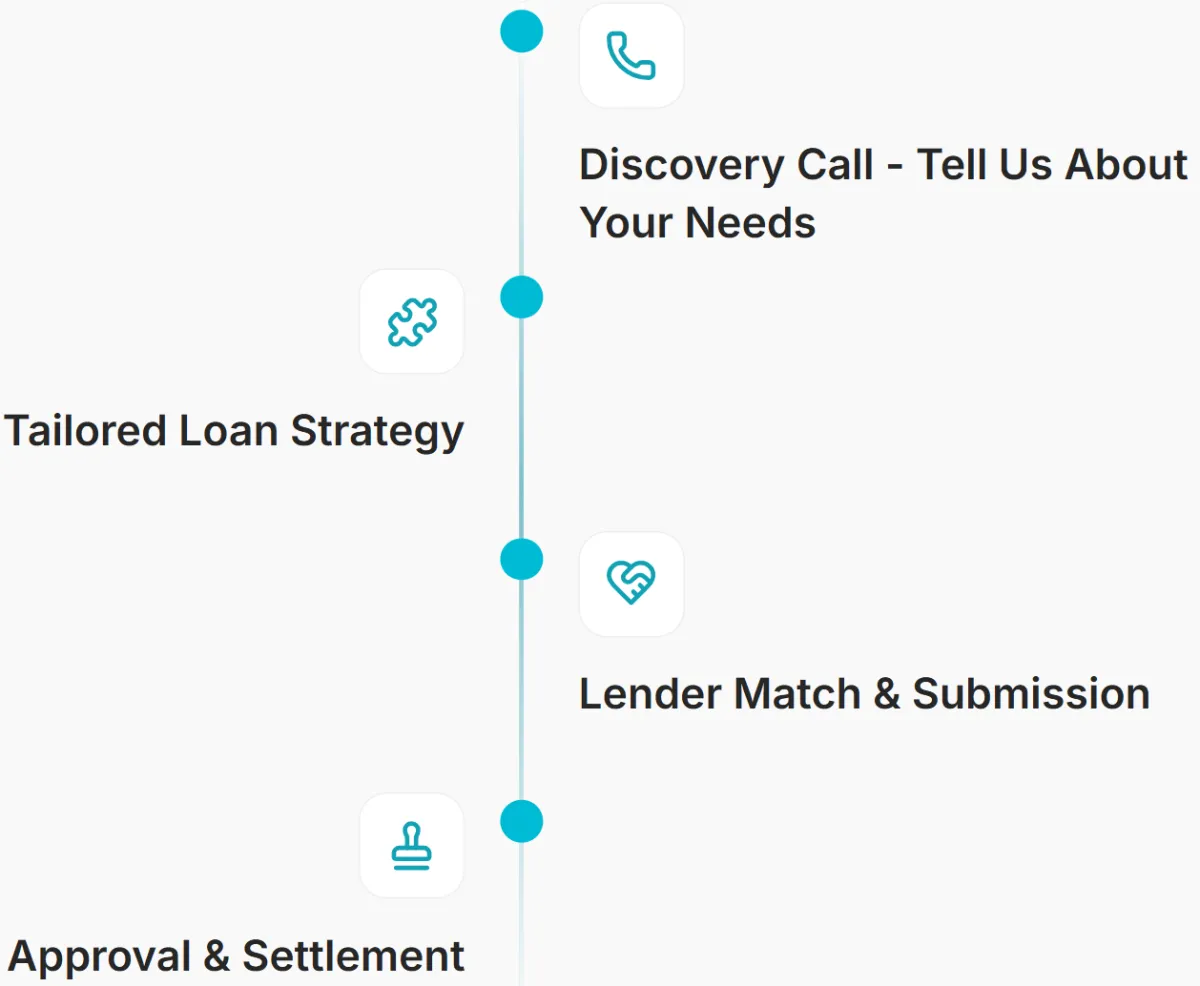

Our Simple 4-Step Loan Process

Hear from Our Happy Customers

Know Your Numbers

Home Loan Repayment

Estimate your monthly repayments based on loan amount, interest rate, and loan term.

Borrowing Power Calculator

Know how much you can borrow based on income, expenses, and liabilities.

Stamp Duty Calculator

Calculate government stamp duty payable on property purchases in your state.

Refinance Savings Calculator

Compare your current loan with a new one to see how much you could save by refinancing.

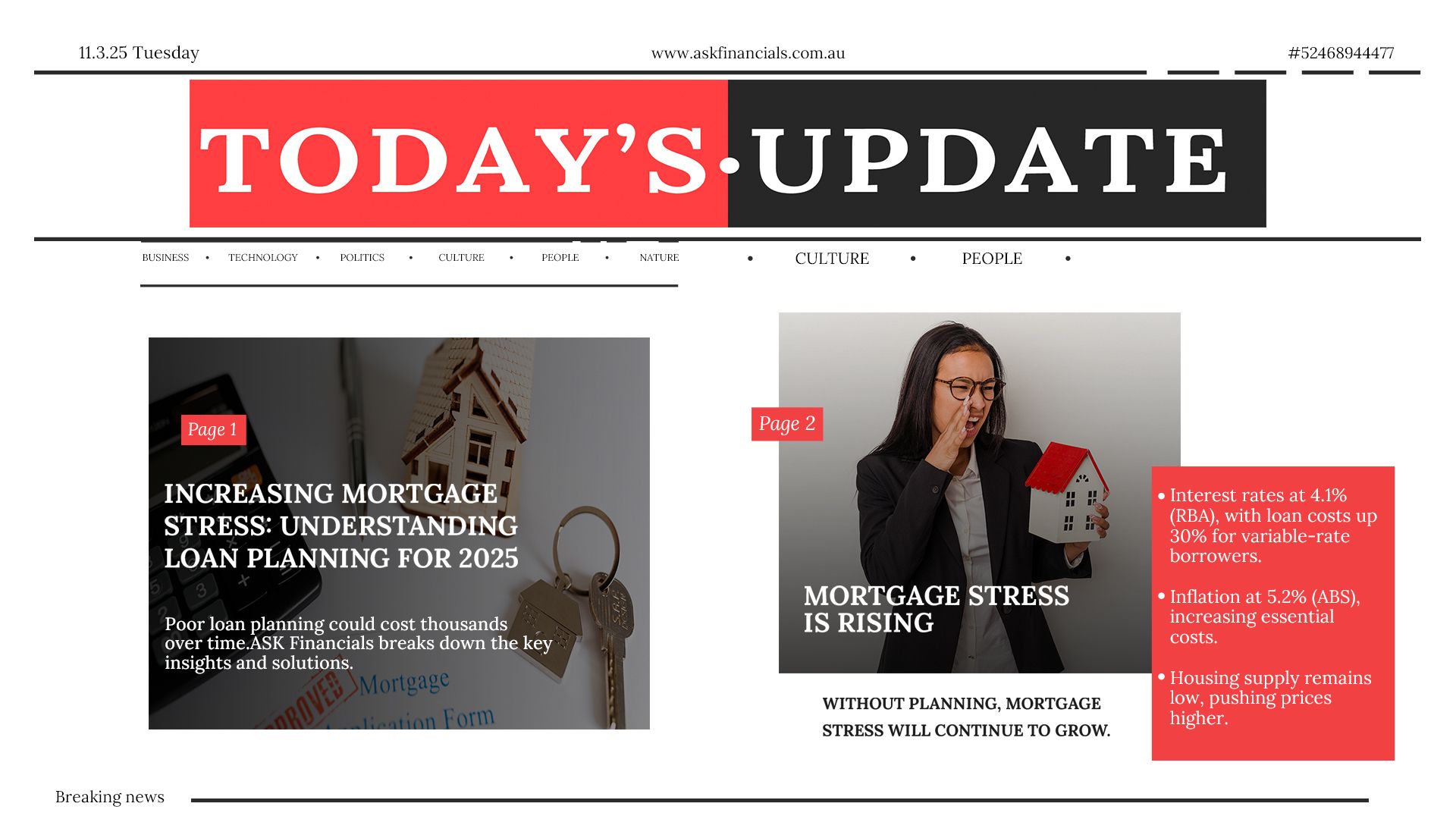

Expert Tips for Smart Home Buying & Investing

Gain valuable insights from experts to make informed home buying and investment decisions

The Importance of a Loan Health Check — Why Annual Reviews Matter

New Blog Post Description ...more

Blogs

January 07, 2026•5 min read

Interest Rate Watch & Forecasts — Will the RBA Cut Rates This October/November?

The Reserve Bank of Australia (RBA) cash rate remains the single most influential lever in the.. ...more

Blogs

January 07, 2026•5 min read

Successful Management of Your Investment Property - Copy

Expert Strategies for Managing Investment Properties Successfully: A Step-by-Step ...more

Blogs

December 18, 2025•5 min read

What a 3.6% Cash Rate Means for Your Next Home or Investment

In November 2025, the Reserve Bank of Australia (RBA) left the official cash rate at 3.6%. ...more

News

January 07, 2026•3 min read

How Spring Rate Cuts Are Driving Buyer Competition

Spring has sprung with a bang in Australian real estate. ...more

News

January 07, 2026•3 min read

Home Buying in 2025: Borrow Smarter in a High-Rate Market

Ready to dive into a digital strategy for your email biz? ...more

News

January 07, 2026•3 min read

Let's Talk - We're Just a Call Away

Have questions or need a custom solution? Our team is ready to help you every step of the way. Get in touch and Let's build something powerful together

Main Links

Main Services

ASK Financials © 2026. All rights reserved.

This is a Paragraph Font

ASK Financials Mortgage Brokers ABN: 48661070962. Credit Representative # 543187 is authorised under Australian Credit License #389087.

Disclaimer: This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.