Today’s update:

| Victoria Property Prices Drop: A Potential Opportunity for Homebuyers

• Rising interest rates are believed to be the cause of the drop in Victoria’s property prices in June. • Western Australia, South Australia, and Queensland are experiencing strong price growth, especially over New South Wales. • The national average price of dwelling in residential dwelling increased by 1.6%. It now stands at $973,300. • Western Australia and South Australia have seen a 6.2% and 4.2% increase in prices respectively. Queensland witnessed an increase of 3.6% in prices. • Rising construction costs and a dip in residential constructions are key factors fueling price growth in certain regions. • Building approvals are not aligning with demand, leading to expected price rise in capital cities over the next two years. • Melbourne’s property market is also experiencing a fall due to higher interest rates, creating an opportunity for new buyers. • Experts recommend diversifying beyond property investments to avoid financial difficulties if property prices significantly decline or correct. • For more information, contact ASK Financials for loan options and the best deal. |

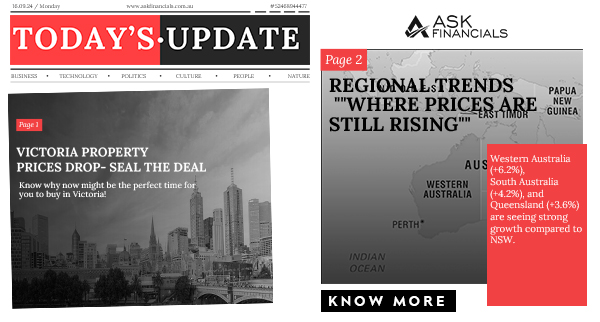

Great news to all the homebuyers: house prices have fallen in Victoria in the June quarter and the experts believe that this is because of the rising interest rates.

Whereas some of the regions are still having strong house price growth in terms of increase. Those regions are Western Australia, South Australia, and Queensland. Also these areas have taken an edge in the price growth over New South Wales.

National Property Prices Reveal Mix Trends

According to the ABS, the government agency the data shows the national average price of residential dwelling has shot up by 1.6%, reaching $973,300.

NSW still holds the most expensive state, where the dwelling price of $1,222,000, on the flip side of the coin Victoria’s average price has dropped from $906,900 to $900,300, we say a dip of 0.73%.

Taking a closer look at the percentage growth, we would like all first home buyers to be aware that W.A. has experienced a 6.2% increase, South Australia has experienced a 4.2% increase, and Queensland has experienced a 3.6% increase.

We believe that those who are looking for the shift or planning to have a new home, Victoria price drop is a great announcement.

Housing Supply Shortage Fuels Price Growth

When we talk about the price growth in certain regions, market experts believe that the rising construction costs and dip in the residential constructions are the key factors for the price growth in properties in certain cities.

Building approvals are not mapping with the demands as a result, property prices in capital cities are expected to rise over next two years, says the industry experts.

Melbourne Price Drop Open Doors For Buyers

Not just Victoria, Melbourne’ property market too continues to show the fall because of higher interest rates, which creates an opportunity for new buyers.

This proves to be the gateway for the new homebuyers as the affordability rises.

I think that Victoria and Melbourne will soon be facing price growth in the property market due to the high demand because of low prices currently.

Experts Recommend Diversifying Beyond Property Investments

If you are a full time investor, then don’t let yourself wash with the low prices in the particular cities, whereas you must focus on diversifying your portfolio.

We think there could be financial difficulties if there’s a significant decline or correction in the property prices. A property market correction occurs when prices drop from their previously high levels, often after a period of rapid growth.

Looking for the right advice for your financial growth “We Are Your Mate”

So if you are a full time Investor or the First Home Buyer or even looking for your second or third investment, it’s good to have experts by your side.

If you have gone through this update and are planning to add a few more zero’s to your portfolio let us be your guide.To discuss your loan options and to get the best deal contact ASK Financials.

Schedule a consultation, visit our website, or just give us a call to find out more. We are ready to be a part of your home buying journey.

| Read More: https://tinyurl.com/asknewsau/ |

| Call Us: 0433 944 055 |

| Book a Free Chat: https://tinyurl.com/askfinancials/ |