As interest rates climb and competition intensifies, understanding how to maximise rental yields has never been more crucial for investors. Here’s how you can turn the challenges into profitable opportunities.

As Australia’s property market continues to evolve, rental yield has become a critical factor for investors looking to stay ahead. With rising interest rates and an increasingly competitive rental market, understanding how to maximise rental yields is crucial for investors seeking to outperform the market.

However, achieving optimal returns is not always straightforward with rising interest rates and a competitive rental market. Here, we examine the cause, effect, and solutions that can help investors navigate these challenges.

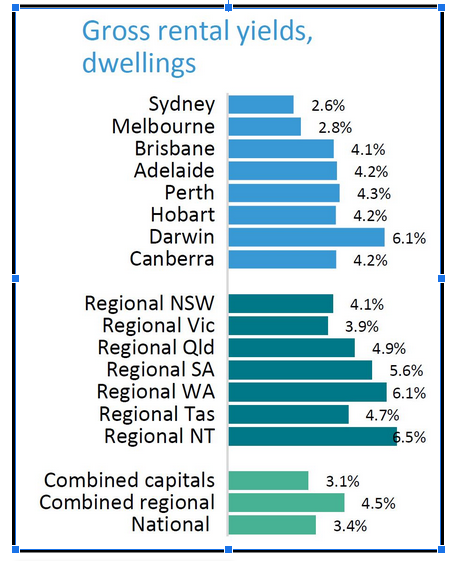

From the chart above, you can see that gross rental yields for homes are higher in Australia’s regional areas than in its capital cities.

➤Rising Interest Rates and Market Uncertainty: The Cause Behind Shrinking Profits

The Australian property market has faced several hurdles, notably rising interest rates and fluctuating property prices. As interest rates climb, borrowing costs increase, impacting investor returns. Additionally, the rental market has been under pressure due to supply shortages and rising demand, leading to higher rents and increased competition for tenants. These dynamics make it more challenging for investors to achieve solid returns, especially when they don’t have a deep understanding of the evolving market trends.

➤The Impact: Missed Opportunities and Shrinking Margins

These issues have an impact on those who invest. Some investors are losing money because higher borrowing rates cut into their rental yields, while others could miss out on excellent investment opportunities because they didn’t properly research the market, the properties’ locations, and the availability of tenants. Thus, investors may have to reassess their property portfolios if they didn’t get the returns they wanted or lost money.

➤Lack of strategic financial planning

The current volatile property market in Australia presents a challenging period for numerous property investors. Additionally, without a comprehensive financial plan, investors often miss out on opportunities that could potentially boost their rental yields. Investors commonly experience some of these issues as pain points.

Rising Interest Rates: As the cost of borrowing increases in this economy, many investors are struggling to maintain profitability.

Competitive Rental Market: Due to the high rental demand, some investors overestimate the price of their properties, expecting a quick return, only to discover that the market operates quite differently.

Concerned about the Property Market: As with any other commodity, changes in property prices and emerging trends will always render returns and investments uncertain in the future.

Missed Opportunities: Investors who lack strategies to manage their investments for better returns may miss out on better opportunities for investment locations or portfolio restructuring.

➤Turning Challenges into Opportunities

These challenges demonstrate the need for a sound strategy in place and the ability to adapt to the rapid changes in the market.

Navigating the Australian property market successfully needs more than just information. It calls for a strong plan combining important elements such as interest rates, supply and demand, location, and legislative changes.

With the right strategy, the challenges of increasing rates and a highly competitive market could potentially transform into profitable opportunities for significant development.

Contact AskFinancials right away to get answers to any questions you have, learn personalised strategies, and gain the knowledge you need to make smart decisions that will help your rental yields. Contact us today!