The property market has rapidly evolved in the post-pandemic era with evolving workplace culture to constantly rising CPI levels, cash rates at decade-high levels, and the influx of overseas immigrants.

All of these factors together have contributed to these shifts as we see them now and will continue to influence them in the future as well.

Property Investment trends across key cities:

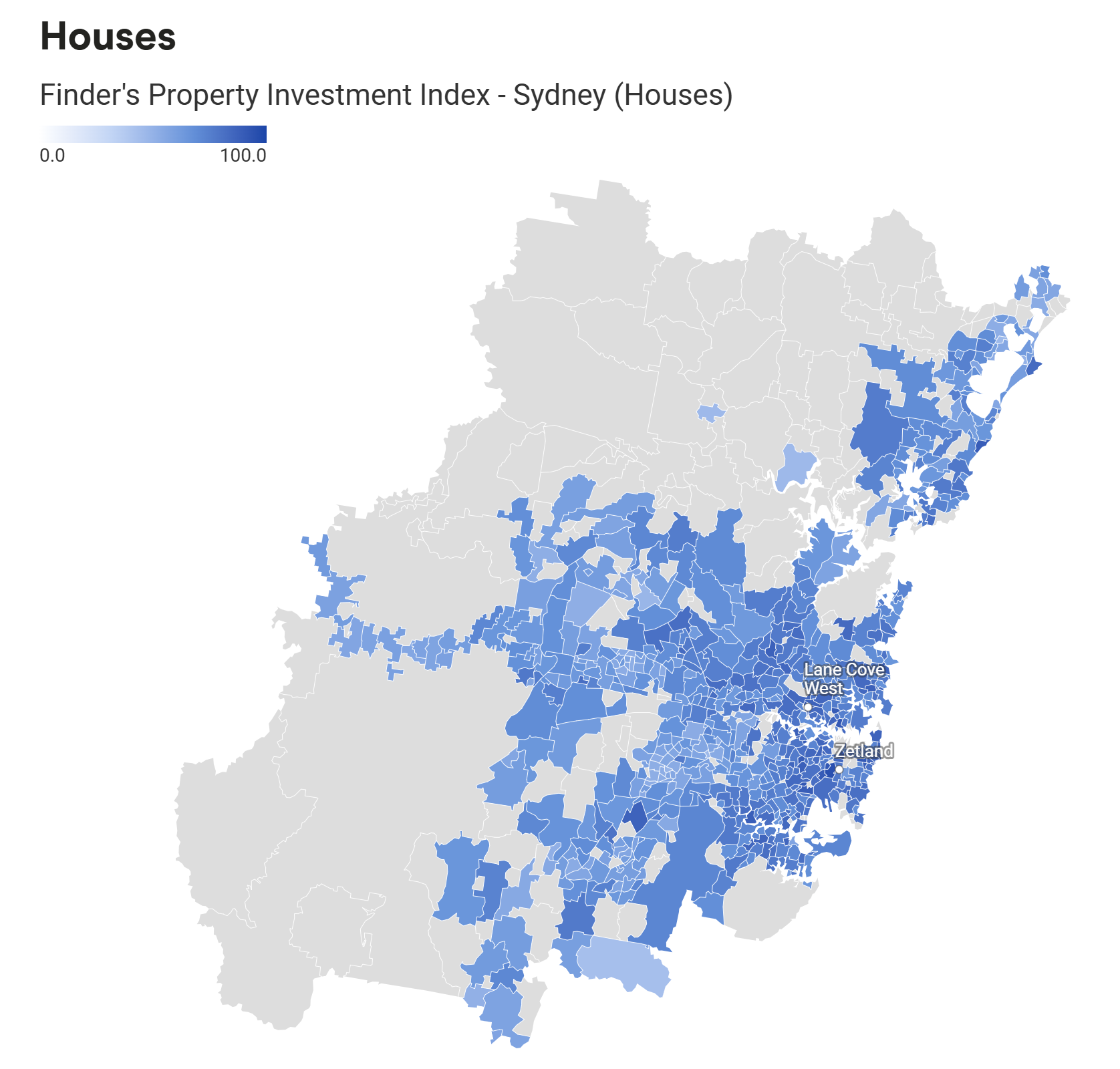

Sydney: Analysis from the comparison site Finder’s Property Index Report for Sydney finds out that the best suburbs for good rental returns and potential capital growth are located towards the inner south region while central coast and western regions are to be avoided from any investment perspective.

Source: Finder’s Property Index – Sydney

Finder’s Property Index takes three key factors into account Market Demand, Population, and Property (Price Growth and current Price levels)

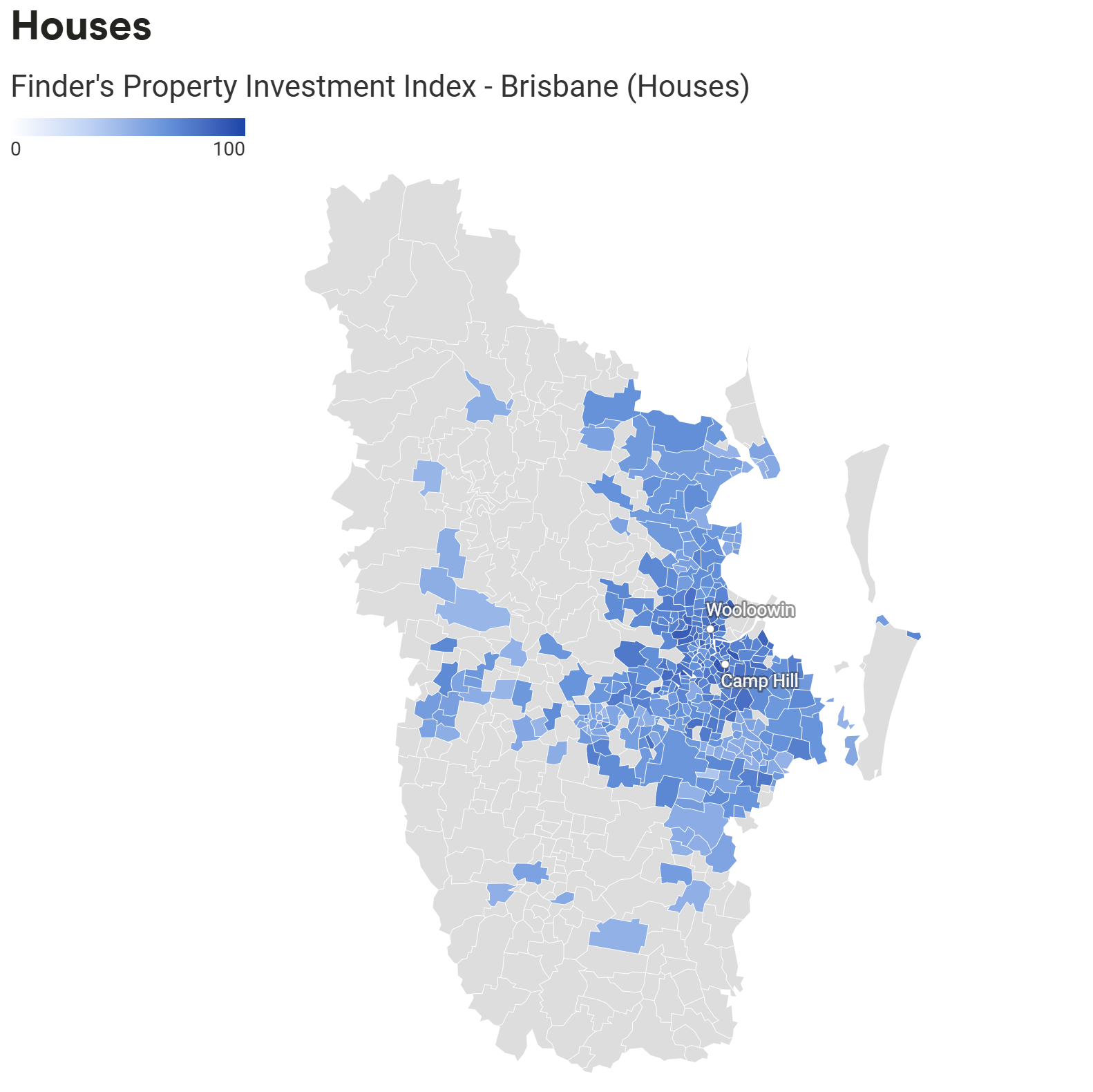

Brisbane: Exhibited the best growth in upcoming inner suburban regions as highlighted in the map below.

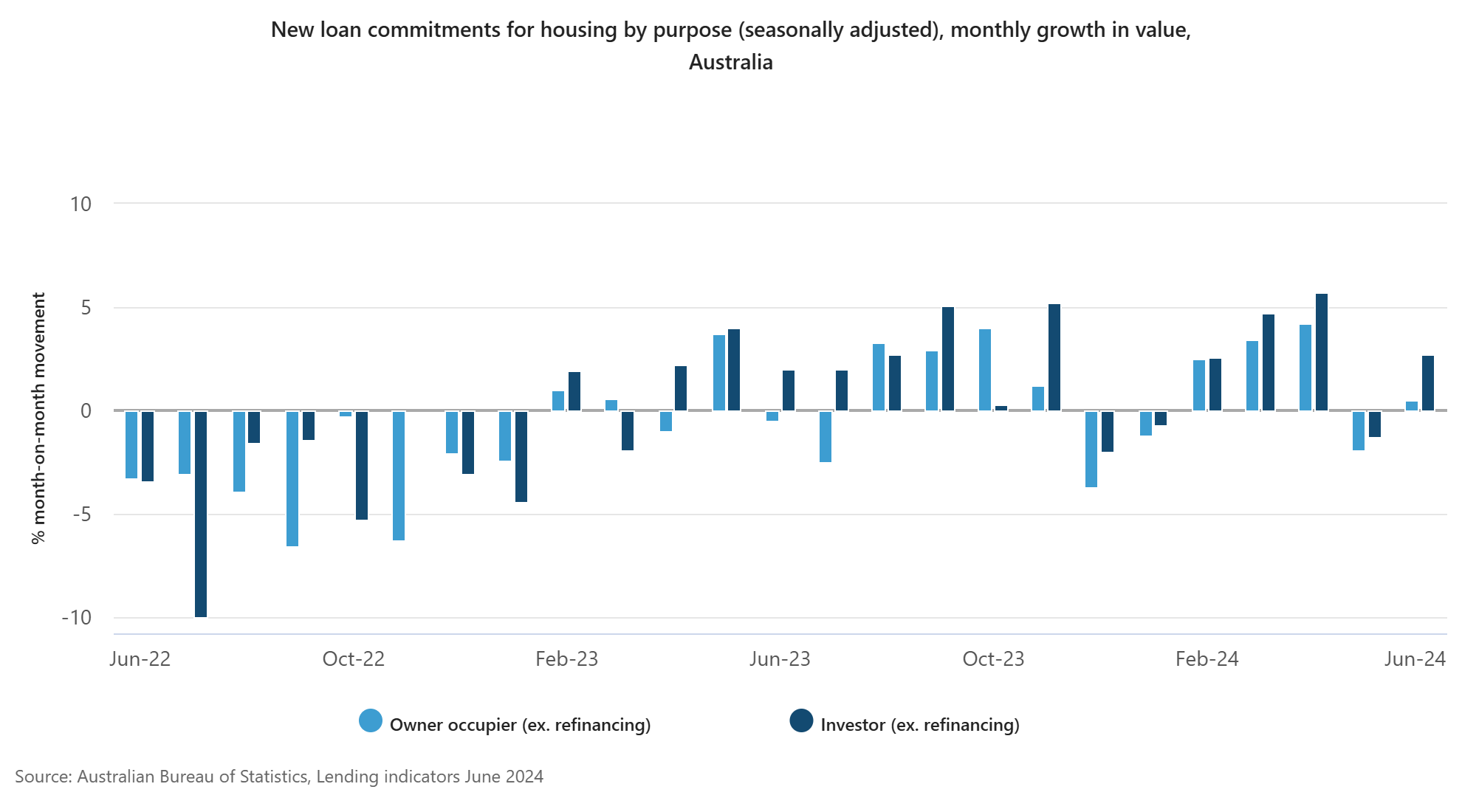

The recent data released by ABS clearly depicts that there has been a surge in the number of investors committing to purchase new mortgages to buy properties as compared to owner occupiers:

On a YoY basis, Investor loan commitments increased by 30.2% while Owner Occupier loan commitments increased by only 13.2%. This drop in the growth rate of owner-occupier loans is primarily attributed to two factors:

- Expired Fixed-rate mortgages rolling over into Variable rate mortgages.

- Decade-high cash rate levels of 4.35%, increasing interest charges of Mortgages

Rise in Investment activity have been fueled by the following factors:

- Rising Rental Returns across different key regions

- Limited housing supply and rising land prices driving unprecedented capital growth in existing properties.

- Supply-side constraint is also creating urgency to buy property before it gets snapped off the market.

Another major shift that has happened in the property market is the rising category of first-home investors, these were first-home buyers who are buying property now for rent-vesting rather than living themselves driven by rising rental prices across regions and further fueled by capital growth promised by existing market dynamics.

This particular segment although still far away from influencing the market in a significant way is growing consistently and is here to stay considering existing property market economic conditions.

Understanding rapidly developing market trends, researching options and course-correcting investment strategies might seem like an uphill task. This is why we at Ask Financials make it a point to craft mortgage solutions that not only work for your goals but keep your financial health in perspective as well.

To Know More, Book a 30-minute Discovery Call with us today.

Call us at 0433 944 055

or

Book a Free Chat: https://tinyurl.com/askfinancials/