More and more First Home Buyers are embracing the idea of ‘Investing before Living.’ This shift in the property market is driven by several key factors:

- RBA’s Decision to Maintain the Cash Rate: While the Reserve Bank of Australia’s decision to keep the cash rate on hold brought relief to many, it did little to ease the burden for first-home buyers. With the cash rate already at a decade-high of 4.35%, this decision merely established a new normal for mortgage holders.

- High CPI Levels: Inflation remains at an all-time high, with rental prices increasing at a staggering rate of 7.80%. Without the Commonwealth Rent Assistance program, this rate could have soared to 12%.

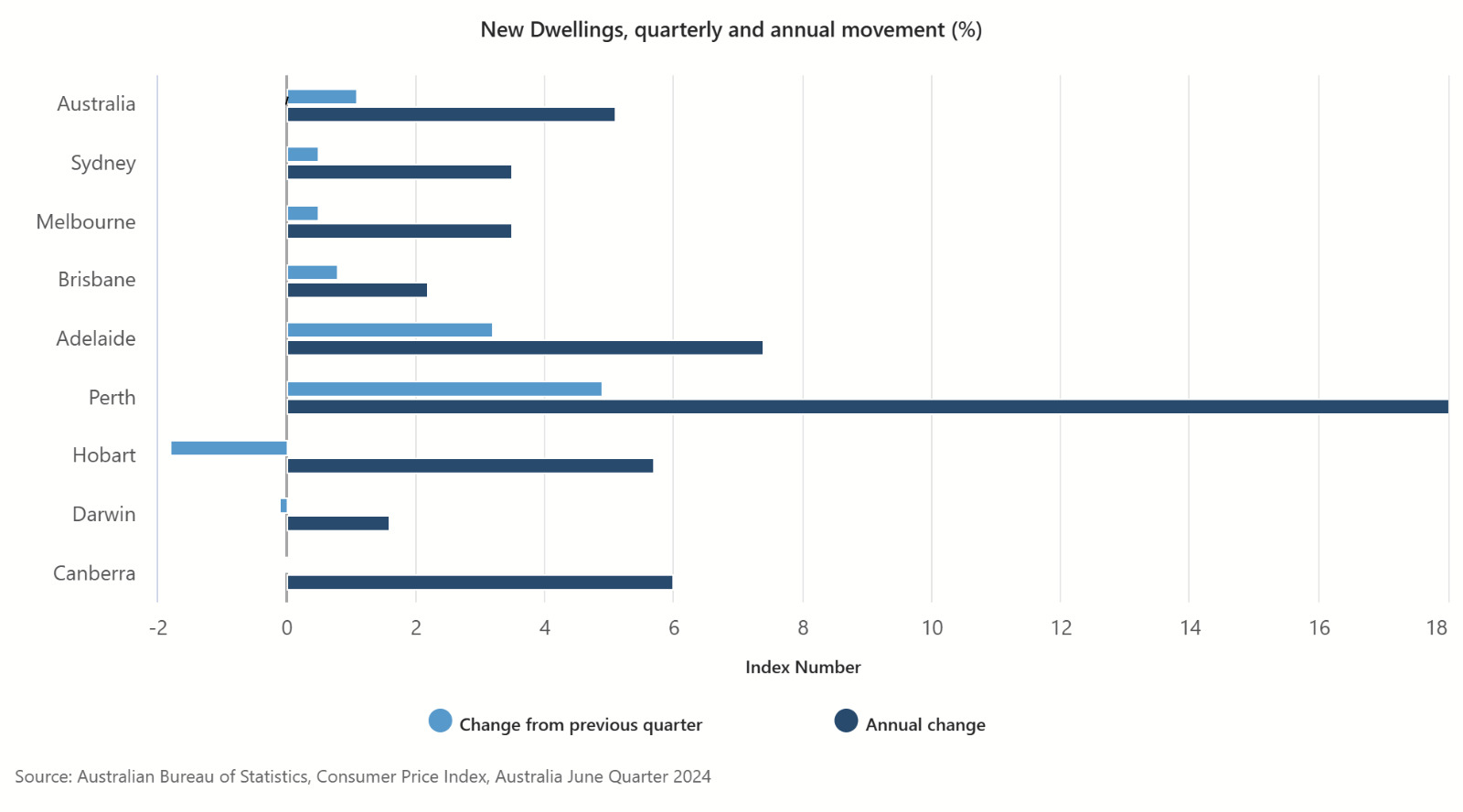

- Rising Property Prices: Property prices in capital cities and CBD areas have skyrocketed, driven by a growing population seeking employment and economic opportunities. Supply-side constraints have further fueled property price growth in these regions.

According to ABS data ending June 2024:

- Owner-Occupier Loan Commitments: Up 13.2% year-over-year.

- Investor Housing Loan Commitments: Up 30.2% compared to last year, partly driven by first home buyers transitioning to first home investors.

State-Wise Growth in This Trend:

- NSW: Leading with 9.42% of first home buyers choosing to invest in 2024, up from 8.62% in 2019.

- QLD and SA: Significant growth, with 7.5% and 7.8% increases, respectively.

Considering the Risks of Investing:

- Management Complexity: Investment properties require managing multiple parameters.

- Higher Interest Rates: First home investors face higher interest rates compared to first home buyers, who benefit from government schemes like FHGS.

- Return vs. Expenses: It’s crucial to assess potential returns and identify positively geared properties.

Navigating the dynamic market and uncertain economic conditions can be challenging. At Ask Financials, we specialize in crafting bespoke mortgage solutions that meet your specific financial needs while maintaining your financial health

To Know more about how we can help, book a 30-minute Discovery Call today.

Call us at 0433 944 055

Or

Book a free chat:https://tinyurl.com/askfinancials/

To read more such articles click here: https://tinyurl.com/2p9tydsr