Aussie households have remained resilient in the face of the rising cost of living and have made it a point to prioritize their financial health by increasingly becoming mindful of their spending patterns & habits.

Australians are redirecting their budget spend on their furry friends & kids; while actively cutting down spend on indulgent activities like dining out, coffee, snacks & entertainment.

Some of the interesting key findings as per the NAB Consumer Sentiment Survey in the past three months are as follows:

- Almost 57% of the sample survey population cut back on eating out, 49% cut back on coffee, snacks & entertainment

- While comparatively only 14%of people have reduced spend on children’s activities, 20% on pets & 23% on miscellaneous activities like cleaning, gardening, etc.

So Aussies made noticeably higher savings amounting to a sum of almost $655, $111 & $68 from cutting back on dining out, petrol & pets respectively in the 18 – 29 years of age group. While those in the age group of 50 – 64 were able to save $787 by cutting back on major household purchases

Women saved comparatively more in the travel plans category amounting to $577 compared to $382 by men. Men saved much more by spending less on private tutors, private school fees & Insurance.

Source: NAB Consumer Sentiment Survey Q2 2024

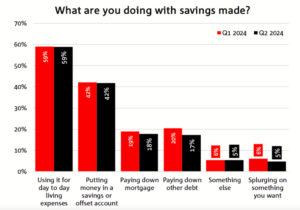

- Aussie households made regular saving and paying against their mortgages a priority as well with almost 40% putting up funds in savings accounts and 20% paying against the mortgages, while 60% of the surveyed sample spent these funds against everyday life expenses.

Primarily this research highlights that what started as cost-cutting measures when everyday life expenditures started increasing has now become a habit across a majority of Aussie households and interestingly enough households have reapportioned these savings towards their pets & children.

So here are 5 Tips on building a resilient financial health:

1.Prioritize Mindful Spending

As demonstrated by the NAB customer sentiments survey 2024, Australians are increasingly conscious of their spending habits. This mindful approach is crucial for financial health. Track your expenses, identify areas where you can cut back (like dining out or entertainment), and reallocate those funds towards savings or essential needs.

2. Build an Emergency Fund

The ability to weather financial storms is essential. Aim to save at least three to six months’ worth of living expenses in a high-interest savings account. This fund can serve as a safety net during unexpected job losses, medical emergencies, or economic downturns.

3. Diversify Your Income Streams

Relying on a single income source can be risky. Consider exploring additional income opportunities, such as investing, or rental properties. This diversification can protect your financial well-being in case of economic fluctuations.

4. Invest Wisely for the Future

Long-term financial security often requires strategic investing. Research different investment options like shares, property, or superannuation. Consider consulting with a financial advisor to create a personalized investment plan aligned with your goals.

5. Protect Your Assets

Safeguarding your assets is crucial for financial resilience. Ensure you have adequate insurance coverage for your home, car, health, and income. Regular reviews of your insurance policies can help identify any gaps in protection.

Remember Building financial resilience is a gradual process. Small, consistent steps can lead to significant improvements over time. By adopting these tips and learning from the trends observed in the Australian market, you can enhance your financial well-being and prepare for future challenges.

Are you looking for ways and means to refinance your existing mortgages, or looking to get the best possible mortgage solution for yourself? We At Ask Financials make it a point to draft bespoke strategies that work for your particular case. Wondering how we can go about planning your mortgage strategies that keep your financial health in perspective and work toward improving it consistently? Book your Discovery Call with us today.

Call us at 0433944055 Or book a free chat:https://lnkd.in/gebsYxVH