The spike in living costs has sparked widespread concern, even catching the attention of the RBA, which is struggling to balance controlling soaring inflation and managing cash rates. According to the latest data from the Australian Bureau of Statistics, employee households are feeling the brunt of this increase the most.

Key highlights include:

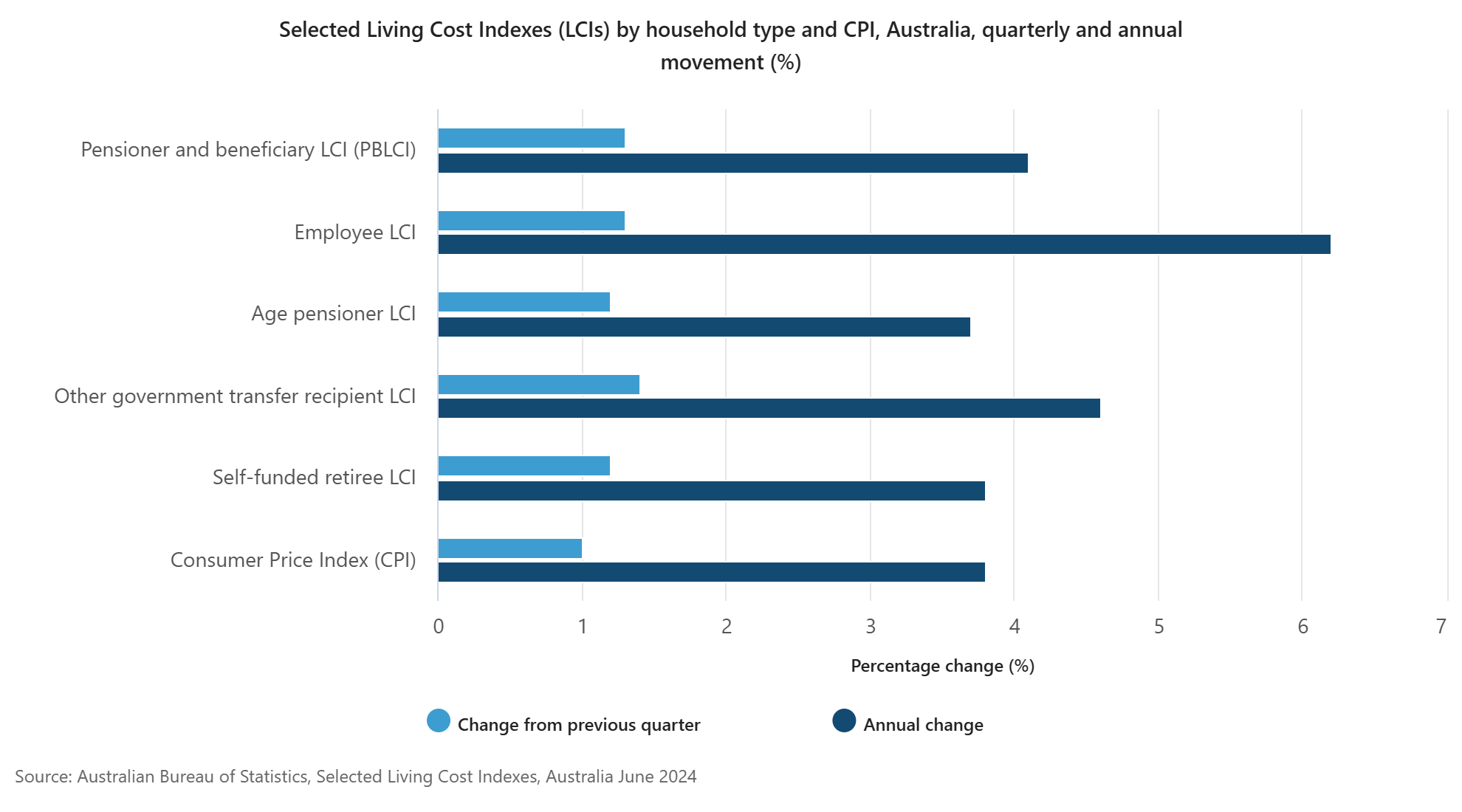

- A 3.8% year-over-year rise in CPI levels, with all five LCI values increasing between 3.7% and 6.2%. The employee LCI saw the highest surge, reaching 6.2%.

- Insurance and Financial Services, along with Food & Non-Alcoholic Beverages, were the main contributors to the quarterly increases across all LCIs.

- Mortgage Interest Charges and Housing Costs had the most significant impact on employee households.

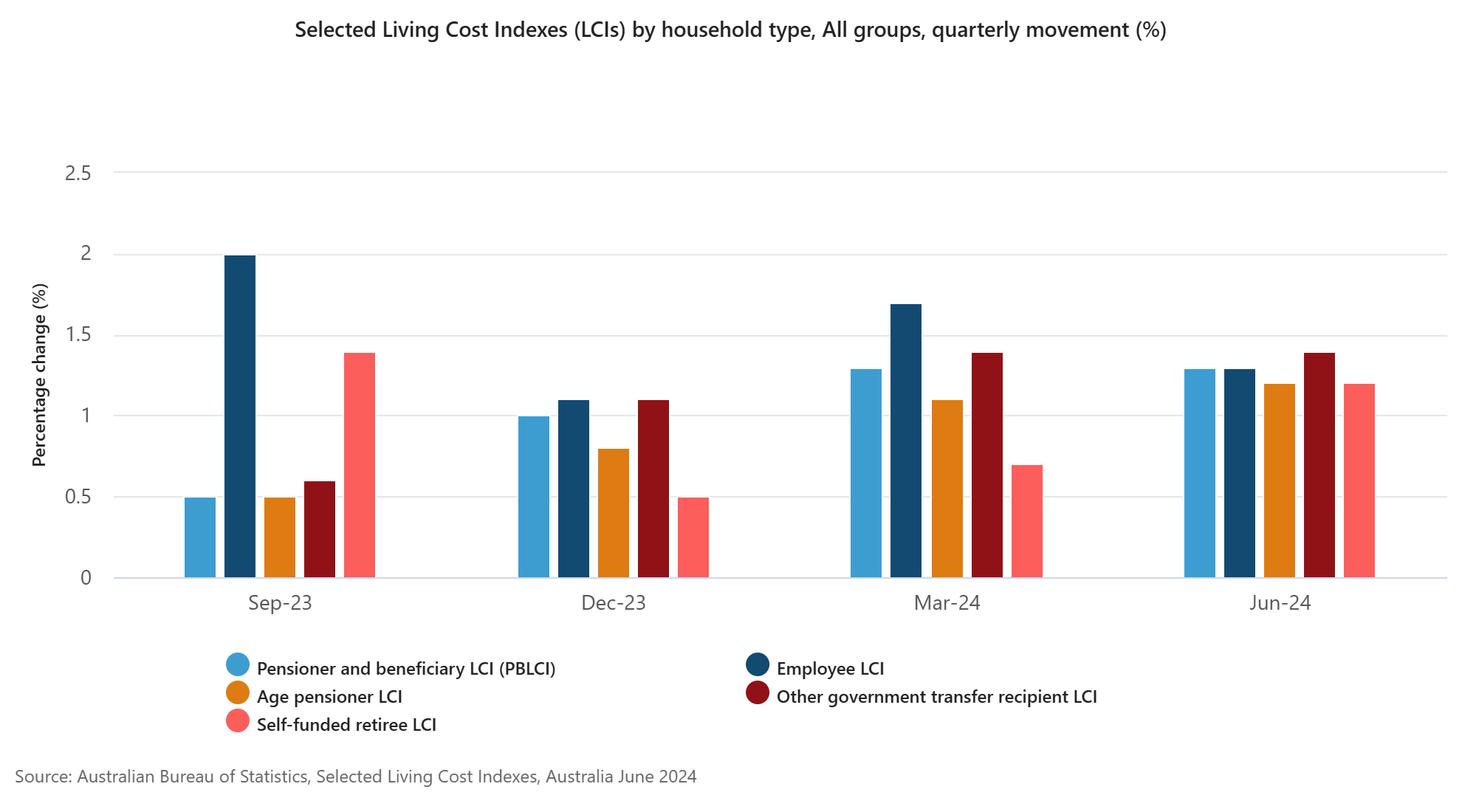

The Employee LCI remained the most affected across all five Living Cost Indices throughout the quarters, as shown in the chart above. This surge is largely due to the rising mortgage interest charges, which followed the RBA’s rapid cash rate increases, now at nearly a decade high.

Key Factors Explained:

- Food & Non-Alcoholic Beverages: The price hike in this category was fueled by poor growing conditions, which drove up the costs of fruits and vegetables, consequently pushing up the prices of processed foods.

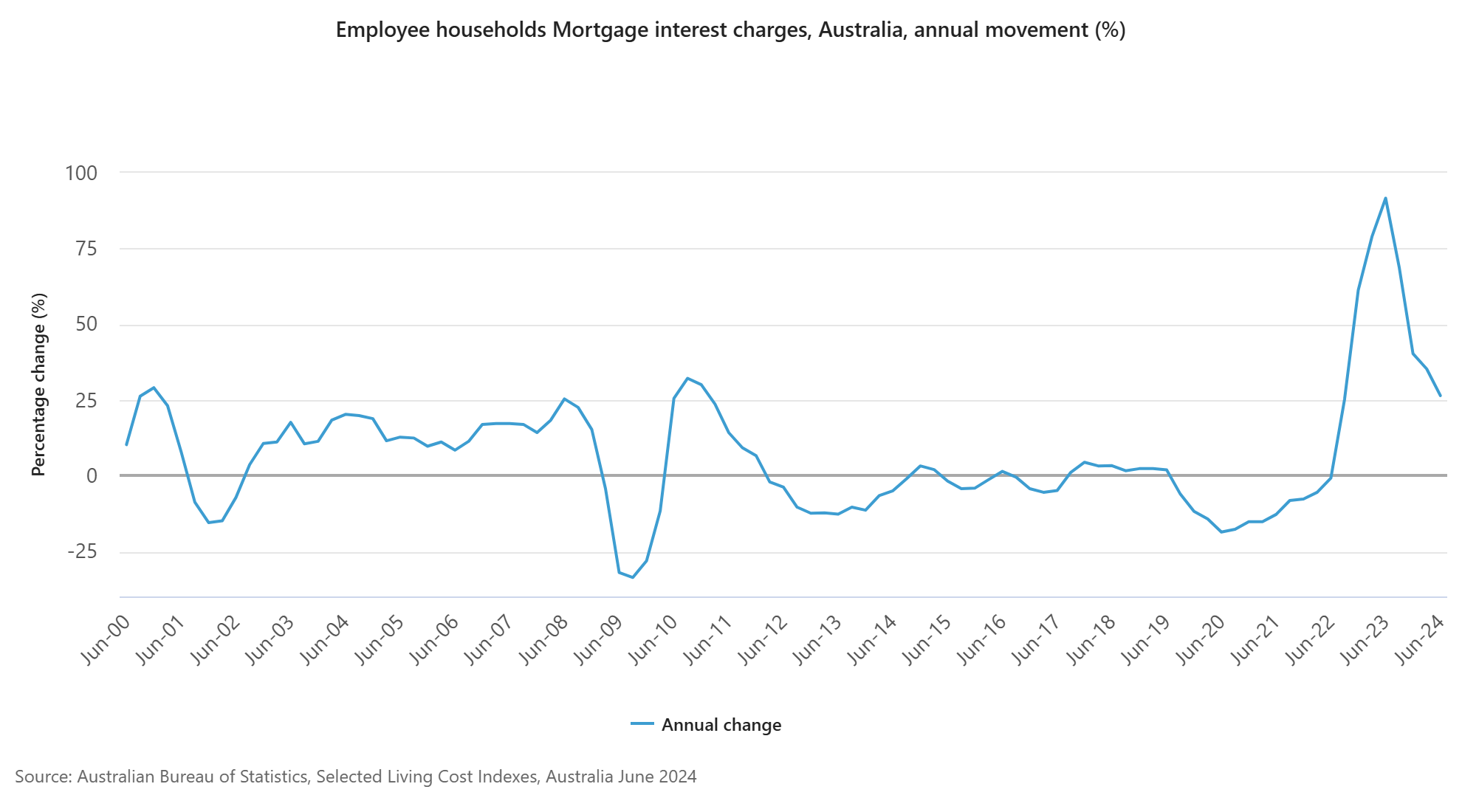

- Mortgage Costs: The rise in mortgage interest charges was primarily due to the rollover of expired fixed-rate mortgages into higher variable-rate ones.

- Housing Costs: Soaring rental prices across various regions have raised concerns within the industry, including at the central bank. Rents have surged by an unprecedented 7%, even with the Commonwealth Rent Assistance program in place. Additionally, rising electricity costs have significantly increased housing-related expenses.

Mortgage interest charges remain a major contributor to the rising cost of living index for employee households, with a staggering 26.5% increase, further straining their expenses. While the RBA’s decision to keep the cash rate on hold has provided some relief, a substantial impact on the average Australian household is still out of reach.

One effective way to manage this burden is by refinancing your mortgage. Many mortgage holders hesitate to explore alternative options due to the overwhelming number of choices and the often complex processes involved. Consulting a mortgage broker is advisable, as they can compare various options and tailor the best possible solution that meets your needs while also considering your overall financial well-being.

At Ask financials we make it a point to keep the load off your financial health and work relentlessly to craft the mortgage solutions that work for your financial goals consistently.

To Understand more,

Book a 30-minute discovery Call today.

Call us at 0433 944 055

Or

Book a free chat:https://tinyurl.com/askfinancials/

To read more such articles click here: https://tinyurl.com/2p9tydsr