Mortgage holders in Australia are projecting positive changes in their spending habits. This encouraging trend might signal a reduction in financial stresses, which increases the possibility of borrowers improving their financial well-being in the long run.

An Increase In Spending Patterns

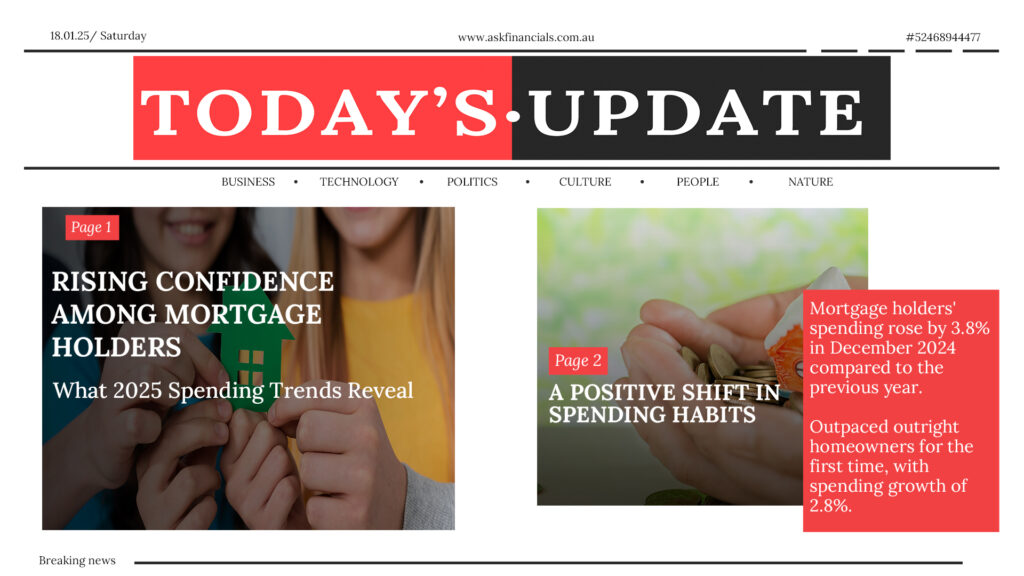

In the latest release of the CommBank Household Spending Insights (HSI) index for December 2024, it was revealed that spending for homeowners with mortgages rose by 3.8% compared to spending in December of the previous year. This is a dramatic increase from last year when spending rose only by 0.4%.

Also, it is important to note that mortgage holders were able to beat outright homeowners for the first time. Their spending grew by 2.8%, which was more than the 2.7% growth in homeowners’ spending. This restores confidence in active borrowers, who seem to be having more confidence in meeting their mortgage commitments.

Recreation Fuels Consumer Sentiment

A large proportion of mortgage holders increased their spending on recreational activities, and this category single-handedly drove the decisive increase in confidence. Increasing the ability to spend on fun and recreational activities means that borrowers have been feeling less financially restricted.

Some categories we can highlight include:

Recreational Spending: A very strong indicator of an improvement in sentiment.

Insurance and Household Services: Highlight the increased focus on long term planning.

However, expenditures on transport and education dipped, indicating changing relative spending priorities.

What About Outright Homeowners and Renters?

Online or over-the-phone insurance services such as homeowners, previously highlighted, had the most spending growth alongside cautious but steady rent growth.

There was only a 2.4% change in spending by renters, indicating constrained spending power. This group focuses mostly on insurance spending with little variation on other expenses.

Favorable Economic Conditions Boost Optimism

Borrowers can now also be optimistic because the economic outlook is more favourable. CBA’s Chief Economist Stephen Halmarick discussed spending trends that underlie economic indicators.

According to his analysis, explaining why spending was weak in December and also along with the improving inflation trend, “these trends reinforce our assessment that RBA interest rates can commence a downturn at the first meeting of the year, which would be in February.” By 2025, we expect some monetary policy easing of 100 basis points.

It is anticipated that reduced interest rates will lessen payment obligations, allowing mortgage owners to channel more money into investment or equity release.

The housing market seems to be regaining equilibrium, with enhanced consumer perceptions of property prices. Currently, these circumstances present both opportunities and challenges for real estate buyers and individuals seeking to improve their standard of living.

For homeowners, 2025 offers a unique chance to guarantee their financial future. This is the perfect moment to act, as the state of the economy is becoming better and interest rates are most likely to drop.

Seize the opportunity to strengthen your financial future in 2025. With improving economic conditions and a potential drop in interest rates, now is the perfect time to reassess your mortgage strategy.

Connect with ASK Financials to explore how you can make the most of these favorable trends.