The Reserve Bank of Australia (RBA) maintained the official cash rate (OCR) constant at 4.35% at its September meeting, as expected by all 42 economists polled for Finder’s RBA Cash Rate Survey.

With inflation continuing over the 2-3% goal zone, Australia’s central bank chose not to slash rates like the US.

However, since numerous major economic indicators hint at a failing economy, there is growing speculation that rates may be slashed before Christmas.

Data also suggests interest rates influencing the economy as planned. The ABS Australian National Accounts reveal that outside of the pandemic, the economy achieved the worst annual financial year economic growth since FY92.

Just Inflation

In a critical juncture, analysts question how tomorrow’s CPI (Consumer Price Index) data may have affected the RBA’s decision.

CPI anticipates “in the low threes or high twos”—possibly meeting the goal range.

If it occurs, this would be the first time inflation has fallen below 3% since August 2021. However, Chalmers observed that monthly inflation data is less important than quarterly ones.

For comparison, inflation increased by 3.5% in the year to July and 3.8% in the June quarter. The next quarterly CPI data is expected October 30.

According to economists, the RBA’s key instrument for regulating inflation is the cash rate. He continued: “While inflation is improving, it’s still not low enough for the RBA to lower rates yet.”

Is the RBA’s inflation target band pointless?

While the central bank’s collective thinking is to take the narrow road to return inflation to a healthy range, other analysts wonder if the 2-3% target band has become an arbitrary and restricting aim.

Some panellists believe that the target range should be either expanded to a wider range or dismantled entirely. These panellists are of the opinion that the RBA is unable to mitigate the effects on specific sectors of the economy due to the current range.

Majority of the panellists agree that the current inflation target 2-3% should be kept in place.

Positive feelings about the economy are still low.

Inflation is a big part of how the RBA makes decisions, but it’s not the only thing the central bank looks at.

The Australian economy is still flat, even though GDP didn’t go into negative growth this month.

NAB’s chief economist says that business optimism dropped in August. He also says that the jobless rate will hit 4.5% by the end of the year.

The ANZ- Consumer Confidence Index also shows a lack of optimism. For a record 85 weeks in a row, consumer confidence has stayed below 85.

The same thing was seen in Finder’s Economic Sentiment Tracker, which measures how confident experts are in five key factors for the next six months: house prices, jobs, pay growth, the cost of living, and family debt.

Average good economic mood hasn’t changed much since August, when it hit a record low of 7%. In September, it was still only 8%.

Both home cost and family debt are still issues, with 60% of experts having a bearish view on both.

The most negative result is for how people feel about jobs, with 73% of experts voicing worry.

Mortgages up, savings down

While academics and pundits debate economic statistics, the official cash rate affects millions of Australians’ budgets.

REIA found that 48% of income goes to housing loans.

New South Wales households spend 57.9% of their income on mortgages.

In September, 40% of homeowners struggled to pay their house loan, according to Finder’s Consumer Sentiment Tracker.

The Australian Bureau of Statistics (ABS) reported that households saved 0.9% of their income last year, the lowest percentage since 2006-07.

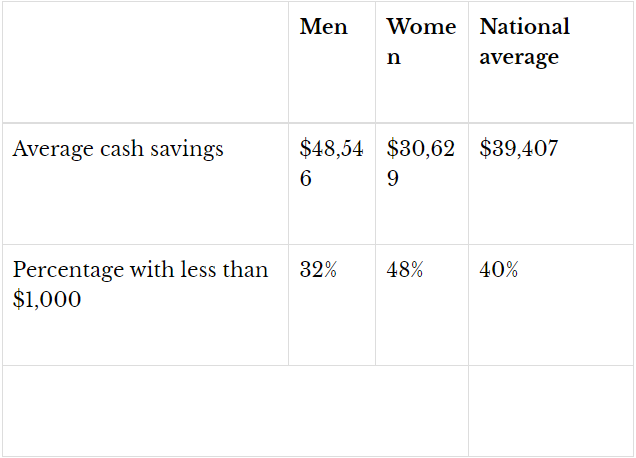

Finder’s Consumer Sentiment Tracker found $39,407 in September cash savings for the typical Australian.

However, the nation’s major savers are definitely lifting the national average, with 40% of Australians having less than $1,000 in their savings accounts.

The majority of experts (67%, 18/27) who responded believe that low household savings rates would result in an increase in household personal debt during the following 12 months.

“With less savings, consumers are more likely to depend on credit cards, loans, and buy-now-pay-later items to make ends meet. These goods may be beneficial when used responsibly, but they can rapidly get out of control if dependent on daily spending.

Are variable rates still a better deal?

While the cash rate remains on hold, 16 lenders dropped 165 fixed rates this week as wholesale financing costs fell.

Indeed, approximately 90% of lenders with both fixed and variable rates have fixed rates at their lowest.

Is that a good moment to fix? The solution seems implausible, especially when the lowest fixed and lowest variables are separated by 0.26 percentage points.

During this lengthy period of high interest rates, Mortgage Choice home loan submission statistics indicated that borrowers are still choosing variable rate house loans.

In August, just 3% of loans had a fixed component, and that trend is continuing in September.

We think the RBA won’t drop rates in four months, but we are assuming it will in six to 12 months.

Only on the 1-year rate did fixing have a chance of winning, and “even then it was a close call” as to whether a borrower would pay less interest with one of the lowest fixed rates against one of the lowest variable rates over the fixed rate period.

Rates for term deposits are also falling rapidly. Only two banks raised term deposit rates last week, while 10 decreased them.

Banking term deposit rates have dropped, raising private credit term deposits, which are normally higher.

Term deposits and fixed mortgage rates were cut due to lower wholesale funding costs and the likelihood of cash rate cuts within these fixed rate terms.

We expect both rates to fall as we approach a cash rate cut next year.

When is the RBA planning the rate cut?

While some predict that the next rate drop will not occur until 2025, others are less certain.

It is unclear when this period of pauses will end, with several economic teams from big banks, including CBA and Westpac, forecasting a rate decrease on November 5.

The RBA last hiked the cash rate to 4.35% in November 2023, and with many homeowners waiting for relief, some anticipate a proactive and popular action before the Christmas season.

The rate decrease is “much more likely this side of Christmas” after the US Federal Reserve reduced interest rates by 50 basis points.

Find a broker! This is how customers may save money.

Consumers are still encouraged to “not wait for the RBA to move the cash rate to see if you can find a better deal” in anticipation of a rate reduction.

If you are anticipating purchasing a property in the spring and have not yet obtained a pre-approval, it is imperative that you schedule an appointment with a mortgage broker at ASK Financials to secure a pre-approval and guarantee that you are prepared to submit an offer as soon as you have identified the ideal property.

The experts at ASK Financials are available to assist borrowers who have not yet reviewed their loan in 2024 in ensuring that it continues to meet their needs.

Mortgage brokers can assist you in determining whether your home loan interest rate remains competitive and whether the structure and features of your loan are suitable for your needs.

—

| Read More: https://tinyurl.com/asknewsau/ |

| Call Us: 0433 944 055 |

| Book a Free Chat: https://tinyurl.com/askfinancials/ |