HSBC has dropped its fixed mortgage rates to 5.59% p.a., and other banks like Westpac and CommBank have also cut rates. Inflation is easing, which might lead to lower cash rates soon. Now’s a great time to check your mortgage options.

This week, the Australian home loan market has seen some notable changes, with HSBC making headlines by dropping its fixed mortgage rates to a new low. Here’s a detailed look at what’s happening in the mortgage market and what it could mean for you.

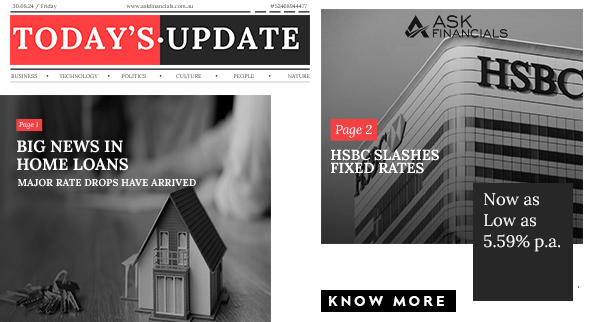

HSBC’s New Rates

HSBC has introduced new fixed mortgage rates that are among the lowest in the market right now. For many borrowers, the bank’s fixed mortgage rates have been reduced to 5.59% per annum (p.a.). This marks a significant drop and positions HSBC as a leading player in terms of competitive home loan rates.

To put this in perspective, HSBC’s new rate of 5.59% p.a. is for fixed, packaged home loan products for owner-occupiers with a Loan-to-Value Ratio (LVR) of 80% or less. This means if you’re looking to borrow money to buy a home and your deposit covers 20% of the property’s value, you could qualify for this rate.

It’s important to note that HSBC’s new package comes with an annual fee of $390. However, this package also includes some benefits like lower interest rates and waivers on establishment, valuation, and settlement fees, which could offset the annual fee over time.

While HSBC is cutting rates on its fixed products, there’s a small increase in their variable home loan rates. The bank has raised the discounted variable interest rate on its Smart Home mortgage product by up to 10 basis points. The lowest advertised rate for this product is now 6.29% p.a. (with a comparison rate of 6.65% p.a.), available to owner-occupiers who have a 20% deposit and are making principal and interest repayments.

Rate Cuts from Westpac and Its Subsidiaries

In addition to HSBC’s changes, Westpac and its subsidiary banks have also reduced their fixed home loan rates. This includes banks such as St George, BankSA, and Bank of Melbourne, which are all part of the Westpac Group.

These reductions might have been anticipated as Westpac itself had previously lowered its fixed rates. The new rates on offer for owner-occupiers with LVRs of 70% or less are available through the banks’ Advantage Package. This package offers a 15 basis point discount on traditional fixed rates but comes with an annual fee of $395.

The fixed rates available through Westpac’s Advantage Package are competitive and reflect the current trend of lower mortgage rates in the market.

Teachers Mutual Bank’s New Variable Rates

Teachers Mutual Bank Limited, which includes Teachers Mutual Bank, UniBank, Firefighters Mutual Bank, Health Professionals Bank, and Hiver, has also made some significant rate changes this week. The bank has reduced its lowest variable home loan rate to 6.14% p.a. for its Your Way Basic Home Loan product.

Here are the new rates for various loan types:

- Owner-Occupiers with LVR ≤ 80%: The rate for the Your Way Basic Home Loan is now 6.14% p.a. (with a comparison rate of 6.20% p.a.), a reduction of 10 basis points from the previous rate.

- Owner-Occupiers with LVR > 80%: For loans where the LVR exceeds 80%, the new rate is 6.79% p.a. (with a comparison rate of 6.86% p.a.), also down by 10 basis points.

- Investors with LVR ≤ 80%: The rate for investment loans is now 6.44% p.a. (with a comparison rate of 6.50% p.a.), after a reduction of 10 basis points.

- Investors with LVR ≤ 80% (Interest-Only Loans): The rate is now 6.84% p.a. (with a comparison rate of 6.67% p.a.), following a 10 basis point cut.

Impact of Inflation and Tax Cuts

These changes come at a time when the inflation rate in Australia has shown a slight improvement. According to the Australian Bureau of Statistics (ABS), the monthly inflation indicator for the 12 months to July was 3.5% p.a., down from 3.8% in the previous month. While this is still above the Reserve Bank of Australia’s (RBA) target range of 2% to 3%, it indicates that inflation is gradually easing.

Experts are hopeful that this could lead to a cut in the cash rate by the RBA in the near future, potentially providing some relief to mortgage holders. Many believe that borrowers might see a reduction in the cash rate early next year, which could further lower mortgage rates.

Additionally, the implementation of stage three tax cuts appears to have provided some financial relief to many Australians. This coincided with a drop in mortgage stress, according to new figures from Roy Morgan. The tax cuts and the lower inflation rate may contribute to easing the financial burden for homeowners.

What This Means for You

If you’re currently holding a mortgage or looking to enter the property market, these rate changes could be beneficial. For those considering refinancing, HSBC’s new fixed rates could offer significant savings compared to previous rates. Similarly, the reduced rates from Westpac’s subsidiaries and Teachers Mutual Bank might be worth exploring if you’re seeking a competitive rate for your home loan.

When evaluating mortgage options, remember to consider not just the interest rates but also the associated fees and terms. HSBC’s annual package fee of $390, for example, should be weighed against the benefits of the lower interest rate and waived fees.

The latest changes in mortgage rates reflect a competitive market and provide opportunities for borrowers to secure more favorable terms. As always, it’s a good idea to compare different loan products and consult with a mortgage advisor to find the best option for your financial situation.

Need Help with Your Home Loan?

With mortgage rates changing, finding the best deal can be tricky. ASK Financials is here to make it easy. Our team can help you understand your options and find the best rate for you.

Get in touch with ASK Financials today for expert advice and to see how you can make the most of these new rates. We’re here to help you find the right home loan for your needs.

| Read More: https://tinyurl.com/asknewsau/ |

| Call Us: 0433 944 055 |

| Book a Free Chat: https://tinyurl.com/askfinancials/ |