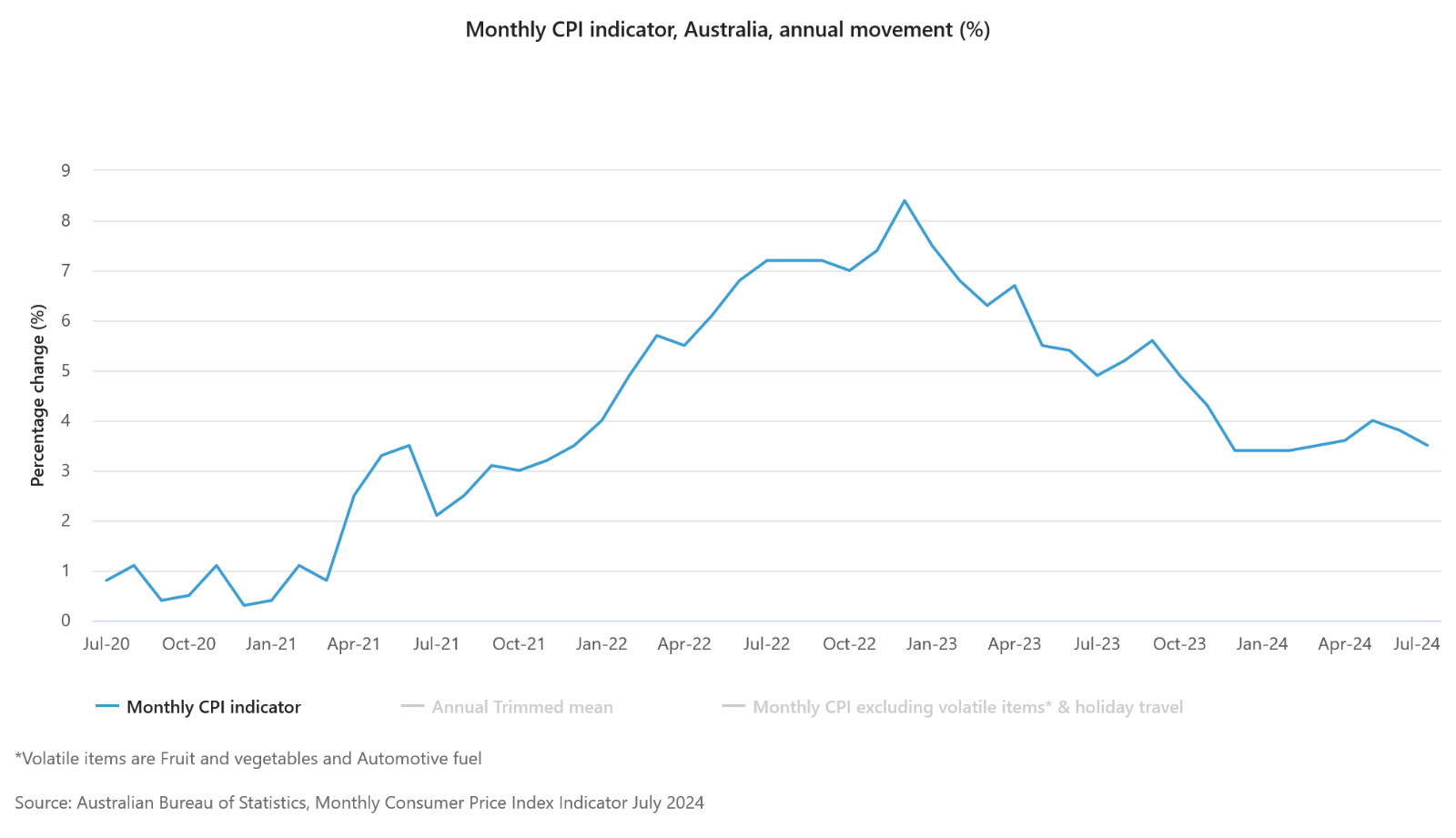

Inflation has eased by 0.3 percentage points compared to June levels of 3.8%, this has stoked speculations for cash rate cuts by RBA sooner amongst mortgage holders, however, economists feel otherwise.

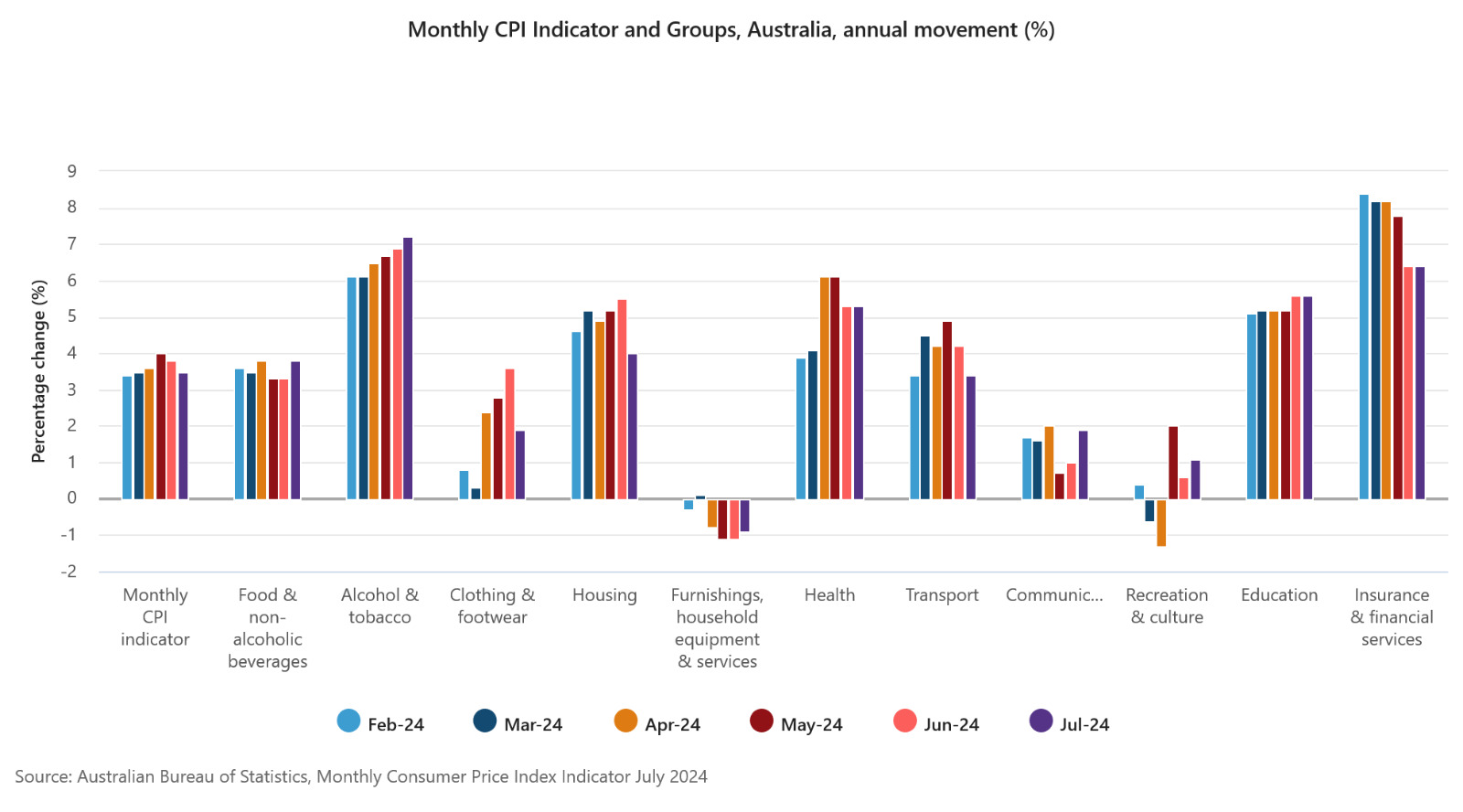

Interestingly, deep diving into statistics revealed that while the costs of financial services and education remained unchanged from their June Levels, inflation in F&B rose to 3.8% in July from 3.5% in June, The annual rise in housing prices was 5.0% down from 5.4% in June.

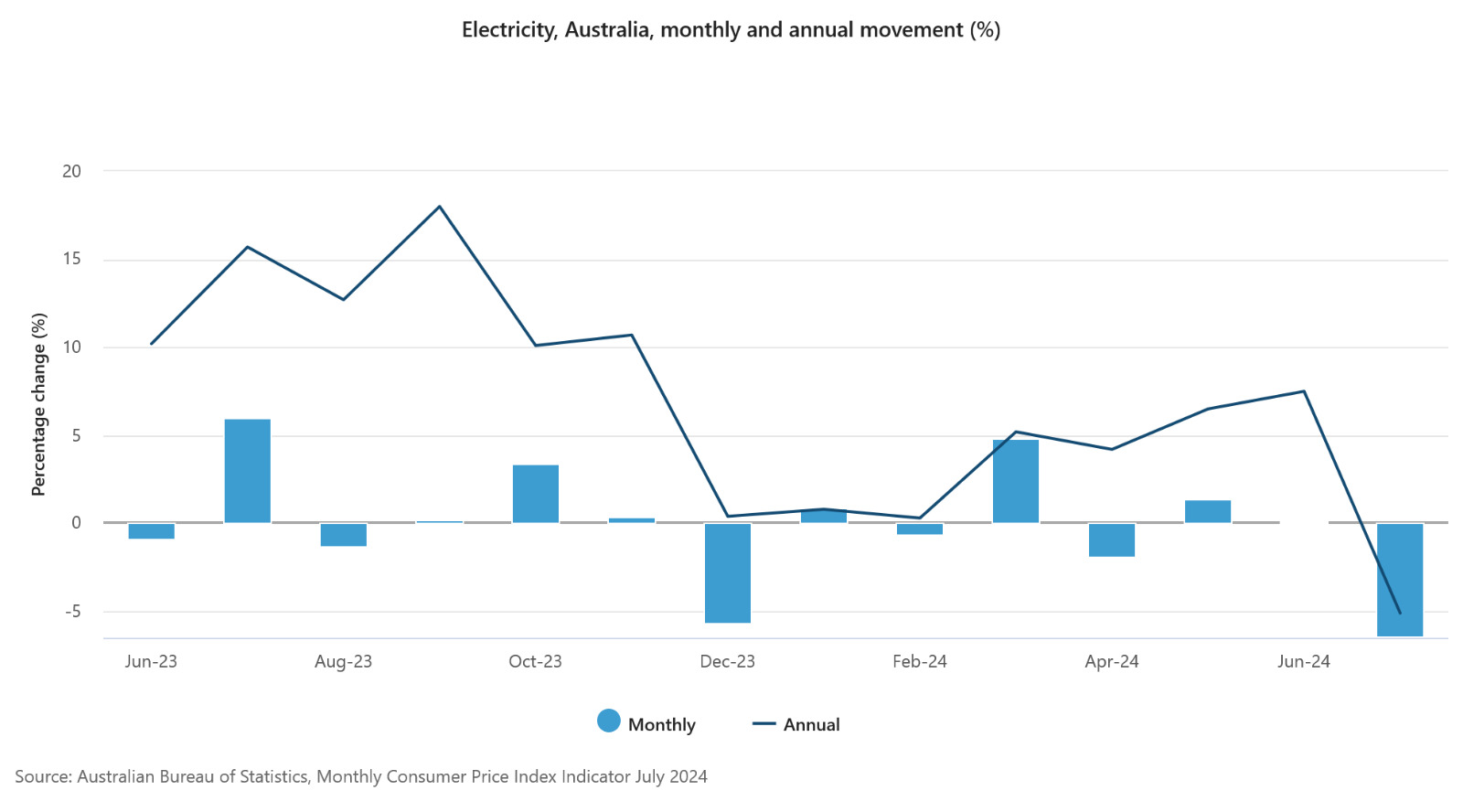

Electricity prices fell by 5.1% from an increase of 7.5% in June. This was primarily the $300 energy bill relief fund rebate by the federal government that has reduced household electricity costs and impacted the Monthly CPI levels for July.

Most of the economists translated these figures as a relief in the short term for Aussie Households but this isn’t a long-term solution. Although primarily they are a government intervention of putting more money in people’s pockets.

Underlying inflation in Other key categories including the education and financial services sector remained high further reinforcing the idea that the eased CPI levels primarily reflect the energy bill relief rebates.

Economists also firmly debate that a cash rate cut shortly is unlikely as RBA would need to look at more realistic Quarterly CPI Data and would need two favorable Quarterly CPI levels to be able to reduce the rates.

RBA governor Michele Bullock said that the central bank is still pursuing its strategy to reduce CPI Levels without pushing the economy into recession & increasing the unemployment levels.

She went on to add further that although RBA understands many people are facing tough times, it’s also essential to keep inflation in check as it hurts everyone in both the short and long haul.

RBA has maintained its Status Quo on keeping the cash rates steady at 4.35% level only for now and is keenly working to bring down the inflation levels to its target range between 2 to 3 % points.

Understanding and staying ahead is the key to managing & future-proofing your financial health better. At Ask financials, we believe that every client has unique needs that need to be addressed accordingly and hence we craft bespoke mortgage strategies that keep your financial health as well as long-term goals in front and center of the whole process.

To know more about how we can help you with your mortgage needs, Book a 30-minute discovery call with us today!

Read More: Read More: https://tinyurl.com/asknewsau/

Call us: 0433 944 055

Or

Book a Free Chat: https://tinyurl.com/AskFinancials/