This week, big four bank NAB changed its prediction for the RBA’s first rate cut from May 2025 to February. This gave people more hope for a rate cut in the near future.

It happened after CommBank pushed back its own rate cut forecast from November to December. This suggests that the market is starting to agree on when variable rate borrowers can expect to get some relief.

New borrowers may not have to wait at all, though, since several big banks are cutting both fixed and flexible interest rates this week.

Whether you’re looking for a new home or thinking about refinancing, keep reading to find out what’s new in the mortgage world.

Variable and fixed home loan rates are reduced by HSBC.

This week, HSBC, an international brand, reduced its variable rates below the coveted 6.00% p.a. mark.

It is currently offering a promotional variable rate of 5.99% p.a. for owner-occupiers with loan-to-value ratios (LVRs) of 60% or less who are opting for its Home Value product.

| Product | LVR | Change | New Rates | Comparison Rates |

| Home Value | <60% | -5bp | 5.99% | 5.99% |

| Home Value | 60-70% | -5bp | 6.04% | 6.04% |

| Home Value | 70-80% | -5bp | 6.09% | 6.09% |

| Home Value | 80-90% | -5bp | 6.39% | 6.39% |

In the interim, investors who are making principal and interest repayments may find these new promotional variable rates to be quite enjoyable:

| Product | LVR | Change | New rates | Comparison rates |

| Investment Home Value | <60% | -5bp | 6.19% | 6.19% |

| Investment Home Value | 60-70% | -5bp | 6.24% | 6.24% |

| Investment Home Value | 70-80% | -5bp | 6.29% | 6.29% |

| Investment Home Value | 80-90% | -5bp | 6.59% | 6.59% |

HSBC has reduced rates on several of its fixed offerings for the second time in five weeks.

The current offerings include two-year fixed rates commencing at 5.59% per annum for owner-occupiers and 5.79% per annum for investors.

Macquarie Bank lowers home loan rates to as low as 5.39% per year.

Not-quite-big-four-bank participated in the activity. Macquarie.

The investment banking behemoth is once again providing some of the most inexpensive fixed-rate home loans on the market.

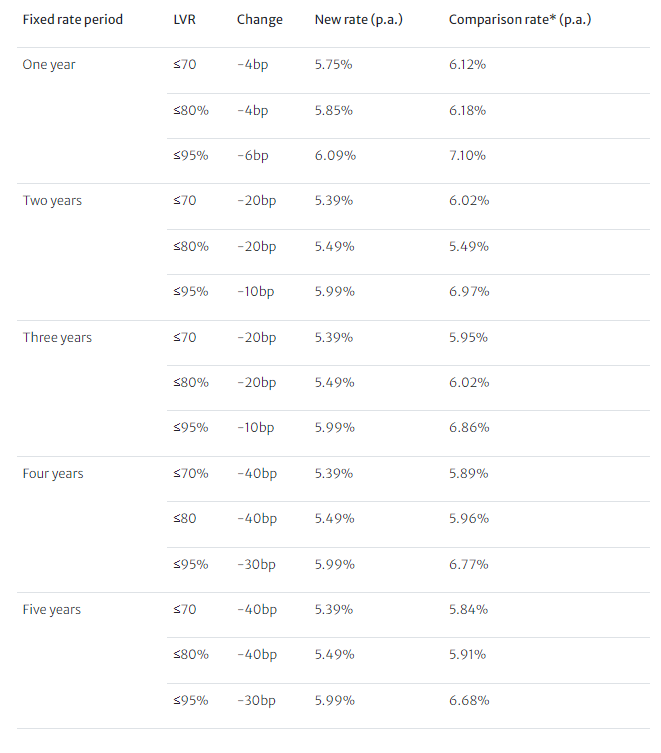

The lender’s Basic Fixed home loan for owner-occupiers now offers the following fixed rates:

Introduced: 5.24% p.a., Bank Australia’s rate is practically the market leader.

This is it: a communal bank with an emphasis on ethics Just 25 basis points more than SWSBank’s special three-year fixed rate of 4.99% p.a., Bank Australia unveiled one of the market’s lowest rates at the moment.

There are stringent qualifying conditions, however the Eco Plus Clean Energy Home Loan from Bank Australia currently promotes a fixed rate of 5.24% p.a. (6.24% comparable rate*).

A 10% down payment and a residence with solar panels and a natHERS rating of 7.5 or above are requirements for the product.

Recently added tariffs are as follows:

Now’s the Perfect Time to Lock in a Lower Rate!

With major banks slashing interest rates, there’s never been a better time to jump on these incredible deals. Whether you’re a first-time homebuyer or considering refinancing, you could save thousands by securing one of these reduced rates today.

Why wait? Start saving with flexible and fixed-rate options from HSBC, Macquarie Bank, and even ethical choices like Bank Australia.

Eco-conscious? Bank Australia’s Eco Plus Clean Energy Home Loan offers amazing rates for energy-efficient homes.

Get in touch with ASK Financials to find the best rate tailored to your needs, and let’s turn these savings into your financial advantage! Don’t miss out—act now and save!

Read More: https://tinyurl.com/asknewsau/

Call Us: 0433 944 055

Book a Free Chat: https://tinyurl.com/askfinancials/