The latest ANZ-CoreLogic Housing Affordability Report sheds light on the challenges faced by Australian homebuyers in 2024. Housing prices and rents continue to rise, far outpacing income growth. This has placed added pressure on those aiming to enter the property market, especially first-time buyers.

What the Numbers Reveal

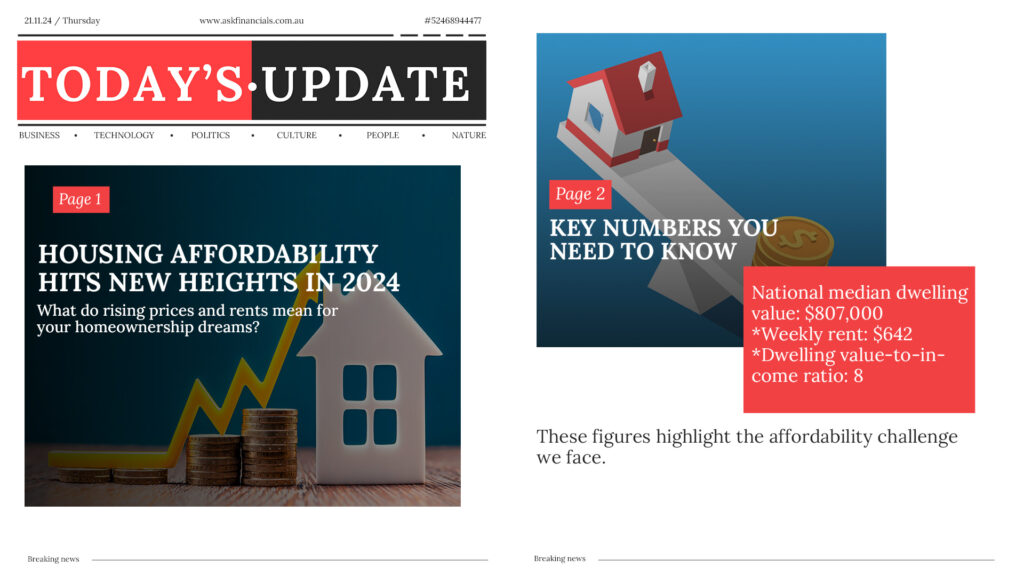

The affordability crisis in Australia is deepening. Key figures from the report show:

- The national median dwelling value has climbed to $807,000.

- Weekly rents have surged to $642.

- The dwelling value-to-income ratio has reached a record high of 8.

These numbers highlight a tough reality for many Australians. A median-income household would now need over 10 years to save a 20% deposit, assuming they can save 15% of their income annually. For many, this makes securing a home seem increasingly out of reach.

👉🏻How to Tackle the Challenges of Homeownership

While the rising costs can feel overwhelming, there are ways to make the dream of homeownership more achievable. Here are a few strategies that can help:

- Understand Your Budget and Financing Options

Assessing your financial situation realistically and exploring different financing options is essential. Knowing what you can afford and how much you need to save is the first step toward homeownership. - Government Grants and Support Programs

Australia offers various government-backed programs aimed at assisting first-time buyers. These can include grants, stamp duty exemptions, and low-deposit loans. Researching and applying for these can significantly reduce the barriers to entry. - Save Smartly for Your Deposit

Saving for a home deposit can be one of the biggest obstacles to buying a house. It’s important to explore creative deposit strategies. This could include high-interest savings accounts, government programs, or even family support schemes. Understanding your options and setting realistic milestones can help make the deposit goal more attainable. - Consider Alternative Housing Markets

In major cities, the competition is fierce, and prices are often beyond reach for many buyers. Looking at housing markets outside the capital cities or in emerging suburbs might offer more affordable options without compromising on lifestyle. - Plan for Ongoing Costs

Homeownership comes with ongoing costs such as maintenance, utilities, and property taxes. When budgeting for a home, be sure to account for these costs in addition to your mortgage payments to avoid future financial strain.

👉🏻Staying Ahead in a Competitive Market

The housing market is constantly evolving, and staying informed is crucial. Trends such as fluctuating interest rates, regional market growth, and shifting rental prices can all impact your decision-making process. It’s essential to stay updated and review your financial situation regularly to ensure you’re making the most informed decisions.

👉🏻Leveraging Technology to Make Better Decisions

One way to stay ahead in a challenging market is by utilizing tools that offer real-time data and insights. Platforms like Investar, designed to analyze market trends, assess affordability, and track loan performance, can be invaluable in helping you navigate the complexities of the housing market. With Investar, you gain the clarity and confidence to make smarter decisions about your home buying journey.

👉🏻The Road to Homeownership

While the path to homeownership may seem daunting, it is still possible with the right planning and support. By understanding the current housing market, exploring available financial assistance, and using tools that streamline the decision-making process, Australians can still achieve their dream of owning a home.

You can book your session for free consulting.