Confidence in the housing market is rising, with new data revealing a 9.1% jump in home loans for the purchase and construction of new homes in the three months leading up to August, compared to the same period last year.

“This growth in lending comes from a shallow base,” said Tim Reardon, chief economist of the Housing Industry Association (HIA). He also noted that lending activity remains near its lowest point since 2002.

The August Lending Indicators report, published by the Australian Bureau of Statistics (ABS), highlighted these trends in housing finance commitments.

First-home buyers take the lead and have been particularly active, spurred by the ongoing rental crisis and a desire to secure their homes.

Homeownership is increasingly viewed as a safeguard against the critical shortage of rental properties. However, significant challenges persist, particularly for first-time buyers.

Stricter prudential regulations over the past decade have reduced competition among banks, making it harder for first-time buyers to secure better financing.

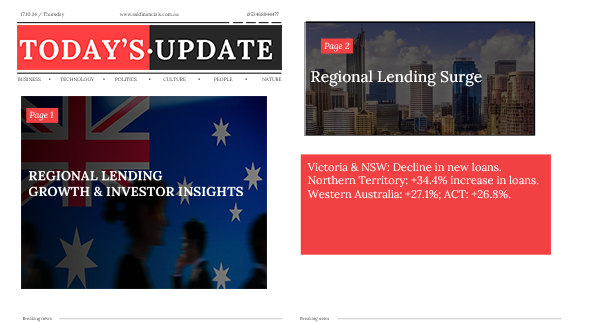

Strong Growth in Regional Lending

While Victoria and New South Wales saw declines in new home loan issuances, other regions experienced robust growth. The Northern Territory led the way with a 34.4% increase in loans, followed by Western Australia at 27.1% and the ACT at 26.8%.

Although lending for new homes dipped slightly by 0.5% in August, it remains 9.1% higher compared to the same period last year.

Mixed Results for Investors

Investor lending dropped by 4% in August but was still 5.5% higher over the three months compared to the previous quarter. Despite a 10.6% decrease in loans for new home construction in August, overall investor lending during the three months to August was up 24.6% from the same period in 2023, indicating cautious yet growing confidence among investors.

If you find this article useful then you can check out our in-depth articles on our website.

Want to know how you could save thousands on your mortgage? Book a free chat with ASK Financials today!