| Home Values in Australia: Rising Trends and Slowing Market Growth

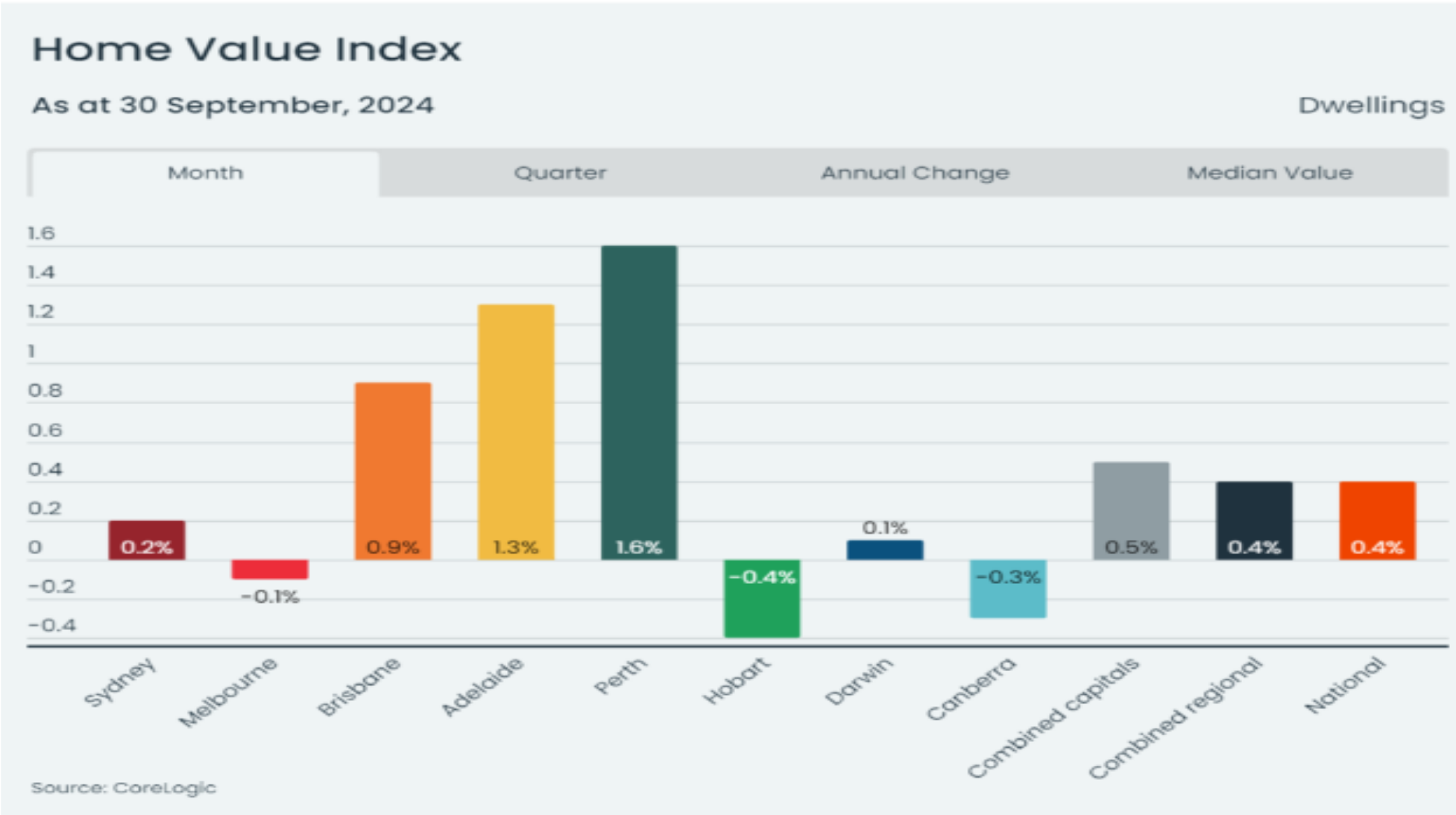

• CoreLogic reports a 0.4% increase in home prices in September, a slight increase from July and August. • The national home value index (HVI) only saw a 1.0% rise in Q3, the smallest since March. • The market is slowing down due to increased demand for homes. • Melbourne, Canberra, Hobart, and Darwin saw the biggest drop in home prices, while Sydney saw the smallest rise since the beginning of 2023. • Mid-sized cities like Perth and Adelaide grew faster than others, but their growth is also slowing. • The number of new listings in Australia is 3.2% higher than last year, and inventories are 8.8% higher than five years ago. • Auction clearance rates are falling to around 60%, and homes are staying on the market longer. • More people are buying affordable homes due to affordability and limited buying power. • Regional home markets have also slowed down, with quarterly gains slowing down from 2.3% in April to 1% in September. |

The national home value index (HVI) gained only 1.0% in the third quarter, which was the smallest rise since March.

During this time, the market is slowing down because more and more residents want to sell.

Some towns get worse while others stay the same.

The prices of homes in four major towns went down during the September quarter.

With a 1.1% drop, Melbourne had the biggest drop. Canberra, Hobart, and Darwin all saw small drops as well.

However, Sydney saw a 0.5% rise, which was the smallest rise since the beginning of 2023.

Mid-sized cities, on the other hand, like Perth (+4.7%) and Adelaide (+4.0%), grew faster than the others, though their growth is also slowing.

Longer times to sell homes when there are more on the market

CoreLogic data showed that the number of new listings in Australia is 3.2% higher than it was last year. Inventories are now 8.8% higher than they were five years ago.

“The rise in homes for sale is a seasonal trend,”

But numbers for sellers are getting worse. Auction clearance rates are falling to around 60%, and homes are staying on the market longer, taking an average of 32 days to sell compared to 29 days in June.

More people want to buy affordable homes.

Problems with affordability and limited buying power have kept demand high in home markets with lower prices.

In the cities, home prices in the bottom quartile went up by 12.4% over the past year, but only 3.8% in the top quartile.

In six of the eight cities, unit prices are rising faster than house prices. This is the case in most major cities.

Growth is slowing down in some regions.

Regional home markets have also slowed down. From 2.3% in April to 1% in September, quarterly gains have slowed down.

CoreLogic stated that the rural housing markets in Western Australia (+3.6%), South Australia (+2.3%), and Queensland (+2.0%) are still growing faster than the rest of the country. This is similar to what happens in major cities.

Read More News Here: https://tinyurl.com/AskNewsAu/

Ready to take market advantage?

Do not wait until it’s too late! Right now is the best time to buy or refinance Your home. Since home costs change all the time, it’s important to have the right credit plan.

As the market changes, ASK Financials can help you find the best financial choices for your real estate goals. Get in touch with ASK Financials right away, and our team of experts will help you turn market trends into chances.

Call us at: 0433-944-055

or

Book a Free Chat: https://tinyurl.com/AskFinancials/