Indicate Changes in Borrowing Behavior

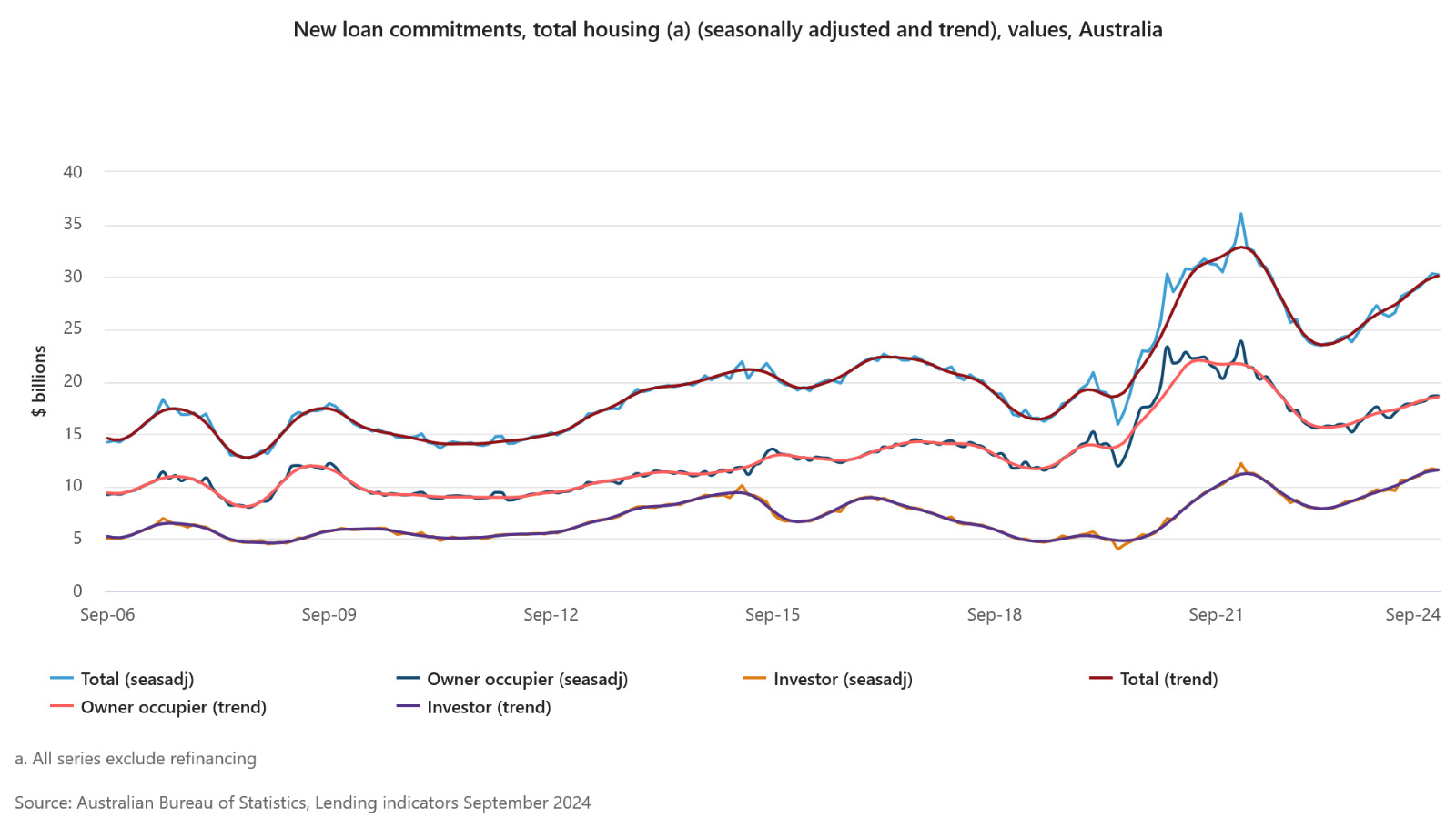

As per the latest ABS data owner-occupier housing increased by 3.5% to $10.4 bn and investor housing decreased by 0.4% to $ 6 bn. The average new home loan size has scaled to an all-time high of $ 642,121.

An increase in the average housing loan size and increasing volume of loan commitments indicate surging demand in the mortgage market even when interest rates are at an all-time high across the last 10 years.

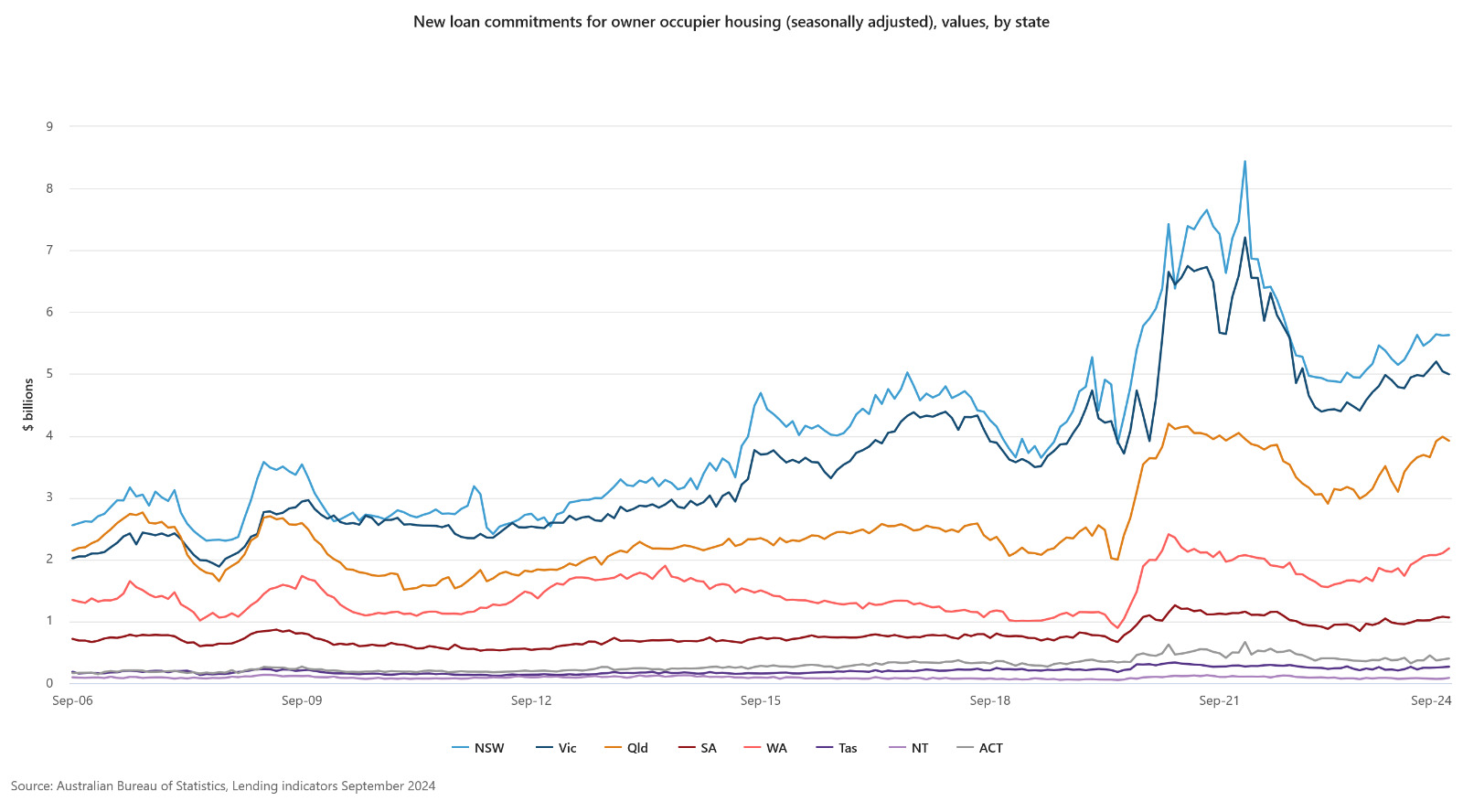

NSW stayed ahead of the pack in leading with the highest amount of loan size standing at $779,239 in September 2024. It is also worth noting that the average owner-occupier mortgage has increased by $43,254, increasing by almost 7.2% on a YoY basis. This comes off as rather unusual with almost no hopes of any cash rate cuts from the central bank. Let’s dive further to understand the underlying dynamics behind this surge in demand for new housing loans.

Understanding Demand across Different States

It is interesting to note that while the overall value of new loan commitments fell in Western Australia and Queensland the average loan sizes increased by $84,000 & $82,000 respectively amounting to 17.6% in WA and 15.2% in QLD growth on YoY basis. This could be a possible reason for the low turnout in overall loan commitments in these states. However, it is a completely different story for NSW, backed by strong demand that led to an increase in not only the average mortgage size but also an overall increase of 1.7% in new loan commitments as well.

State of Mortgage Refinancing

Refinancing activity improved almost by 2.1% points to the previous month amounting to a total of $16.43 bn. This highlights the point that borrowers are proactively looking to get better rates in the wake of the fact that the central bank is not going to announce rate cuts any time soon.

It would be difficult to make any strong conclusions at this point but it is safe to state with an increase in total value of lending from the last year by 18.9%, with strong investor sentiments showing growth by 29.5%, a decrease in September could be one of the inflection points towards market correction.

If you find this article useful then you can check out our in-depth articles on our website.

Want to know how you could save thousands on your mortgage? Book a free chat with ASK Financials today!