Under the prevalent quantitative tightening conditions, Aussies have been feeling the squeeze with rising costs of living and increasing property prices are actively putting the dream of owning a home out of the affordability net.

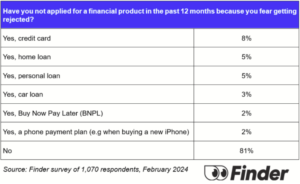

A growing number of Australians are shying away from applying for credit, with millions avoiding financial products due to concerns about being rejected, according to new research from Finder. The comparison site’s survey of over a thousand people revealed that nearly one in five Australians – that’s about four million people – have held off on credit applications in the past year alone.

The rising cost of borrowing has made lenders more cautious about who they lend to. This increased scrutiny is making potential borrowers nervous.

This fear is impacting a wide range of financial products. Credit cards, personal loans, and home loans are among the most avoided, with car loans and even phone payment plans also seeing a decline in applications.

To improve your chances of credit approval:

- First, avoid financial red flags like payday loans, cash advances, and buy now, pay later (BNPL) services. These can signal to lenders that you’re struggling to manage your finances.

- Second, check your credit score. A good score can open doors to better loan terms, quicker approvals, and even smoother rental processes.

The broader economic climate is also playing a role. With the cost of living on the rise, many households are feeling the pinch. This is creating a challenging situation where those who need credit the most are often unable to access it, while those who qualify may need it less.

Even a small interest rate reduction can lead to significant savings over time for homeowners focusing on their mortgage. And for those struggling with debt, creating a repayment plan is essential. Balance transfer cards or negotiating with your credit card provider for a lower interest rate can provide some relief.

Beyond managing credit, Aussie households can take several steps to improve their overall financial health:

- Create a Budget: Understanding your income and expenses is crucial. A budget helps you identify areas where you can cut back and save more.

- Emergency Fund: Aim to save at least three to six months’ worth of living expenses for unexpected situations.

- Diversify Income: Consider additional income streams, such as freelancing, investments, or rental properties.

- Financial Education: Learn about investing, budgeting, and other financial concepts to make informed decisions.

- Regular Reviews: Periodically assess your financial goals, investments, and insurance coverage to ensure they align with your life stage.

By combining these strategies with responsible credit management, a stronger financial future can be built effectively without relying on small credits.

Although the fear of rejection can be debilitating for many Australians from accessing the financial products they need but by understanding the factors influencing credit approval and taking proactive steps, individuals can improve their chances of success.

The mortgage Buying process can be overwhelming, so we At Ask Financials make it a point to draft bespoke strategies that work for your particular case. Wondering how we go about planning and safeguarding your investment journey? Book your Discovery Call with us today.

Call 0433944055 Or book a free session here