Alan Oster, the chief economist at NAB , anticipates that the Reserve Bank of Australia (RBA) will commence the process of reducing interest rates in February as inflation continues to subside and wage growth stabilises.

According to Oster, the most recent inflation and labour market data suggest that the economy is becoming more balanced, which could lead to rate cuts.

NAB anticipates that the Reserve Bank of Australia’s subsequent action will be downward, with the initial rate reduction anticipated for February. The inflation backdrop is diminishing, and the risks are shifting towards the alleviation of real income pressures for households.

The case for rate cuts is strengthened as inflation decreases.

In August, Australia’s inflation rate decreased to 2.7% year-over-year, as subsidies on electricity costs alleviated the burden on consumer prices.

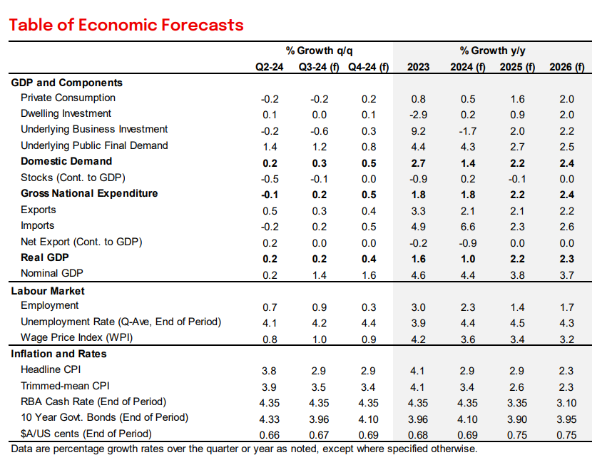

The chief economist anticipates that inflation will steadily decrease towards the midpoint of the Reserve Bank of Australia’s 2-3% target range by 2025. According to him, core inflation is anticipated to stabilise at approximately 3.4% by the conclusion of 2024.

The projections indicate that inflation will decline, which will enable the Reserve Bank of Australia to transition to an easing cycle.

Rate reductions are bolstered by wage trends and economic expansion.

It was also indicated that the RBA’s policy adjustment will reflect a decrease in wage growth and an increase in household revenues.

It is anticipated that wage increases, which reached their highest point in 2024, will stabilise within the range of 3-3.5%. This will provide the Reserve Bank of Australia with the ability to reduce rates without increasing inflation.

The consumption will be further supported by tax cuts and energy subsidies, which will further alleviate inflationary pressures.

The Reserve Bank of Australia’s cautious approach in the face of global uncertainty

The Reserve Bank of Australia’s cautious approach in the face of global uncertainty

NAB anticipates that the Reserve Bank of Australia (RBA) will commence rate reductions in early 2025; however, it is doubtful that the bank will implement a precipitous approach.

The Reserve Bank of Australia (RBA) will prioritise a “soft landing” for the economy, which will involve a delicate balance between inflation control and employment growth.

The Reserve Bank’s primary objective is to sustainably manage inflation while simultaneously preserving the recent progress made in the labour market. The tempo of rate reduction could also be influenced by global factors, such as China’s economic decline, according to the NAB economist.

By mid-2025, NAB anticipates a progressive recovery in consumer expenditure and consistent economic expansion.

This approach suggests a slower and later pace of cuts than in other advanced economies, which is indicative of the Reserve Bank of Australia’s more tempered initial stance.

ASK Financials can help you prepare for the upcoming rate cuts

Are you interested in the potential effects of these rate cuts on your investment or mortgage strategy? ASK Financials is capable of assisting you through this evolving market. Please contact us today to learn how to capitalise on these forthcoming modifications and safeguard your financial future.

If you find this article useful then you can check out our in-depth articles on our website.Want to know how you could save thousands on your mortgage? Book a free chat with ASK Financials today!