ANZ, one of the big banks in Australia, has lowered its interest rates on fixed-term home loans. This means that if you borrow money from ANZ for a home loan with a fixed interest rate, you’ll now pay less each month.

The new rates are lower than before, especially for those who want to lock in their interest rate for two or three years. This is good news for people who are buying a home or refinancing their existing loan.

ANZ’s decision to cut rates follows other major banks who have also lowered their rates recently. This is because people are expecting the Reserve Bank of Australia (RBA) to reduce interest rates soon.

Overall, this is positive news for people looking for a home loan in Australia. The lower rates mean that you can borrow more money or pay less each month.

ANZ has slashed homeowner mortgage rates by as much as 60 basis points.

An individual’s ability to afford a mortgage today, as opposed to yesterday, will be significantly affected by ANZ’s reductions in fixed rates.

A 30-year, $500,000 house loan with a three-year fixed rate term might have its costs affected by ANZ’s fixed rate drop, as shown in the chart below:

| Interest Rates | Approx Monthly Repayments | Total Interest Paid Over Three-Years Fixed Period |

| 5.99% | $2,995 | $88,189.19 |

| 6.59% | $3,190 | $97,213.20 |

The new rate from ANZ of 5.99% p.a. could lower monthly payments by about $195 for a 30-year, $500,000 mortgage that is set for three years. Over the three-year term, buyers would save almost $9,000 in interest.

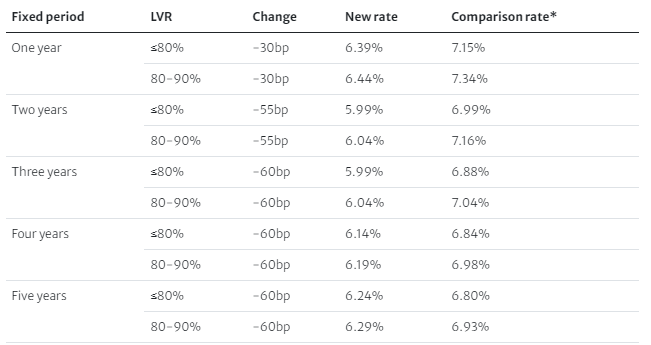

Here are all the changes that ANZ has made to its fixed rate line up for homeowners who are paying back both the capital and the interest:

This is a big drop for buyers from ANZ in fixed home loan rates.

This is a big drop for buyers from ANZ in fixed home loan rates.

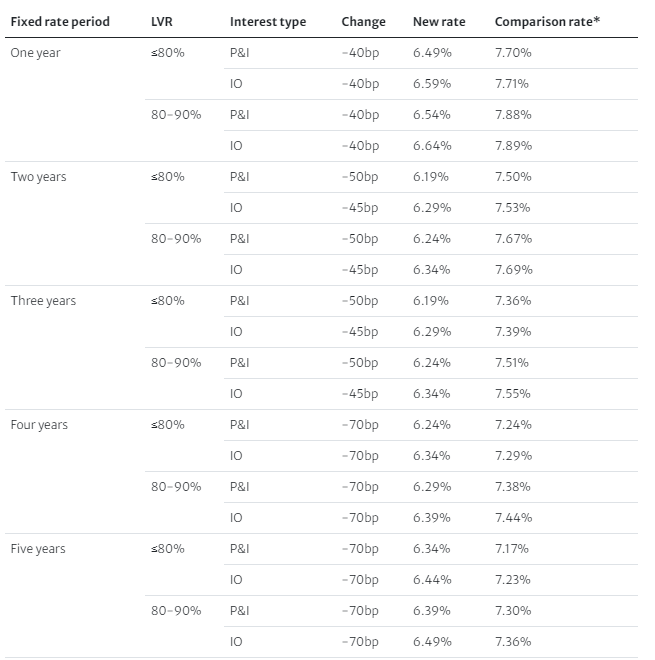

Rate cuts from ANZ aren’t just for owner-occupier mortgages.

Rate cuts of up to 70 basis points have also helped investors. For two and three year fixed deals, new rates start at 6.19% p.a.

The bank has made the following changes to its line of investment home loans: How are you going to use ANZ’s rate cuts?

How are you going to use ANZ’s rate cuts?

ANZ has lowered fixed home loan rates, so now is a great time to look over your plans for a mortgage or an investment. These drops in rates can save you a lot of money, whether you own a house or trade. But it’s not always easy to read the small print and get the best deal.

You can get help from ASK Financial. We are experts at helping Australians get the best rates and borrow as much as they can. Get in touch with us right away for a free meeting and find out how we can help you save a lot of money!