Hi Readers,

A quick summary on the current cash rates in Australia.

| Synopsis

Home Loan Interest Rates as of June 2024 • The Reserve Bank of Australia’s (RBA) cash rate is at its highest level in over a decade, significantly impacting home loan interest rates. • The typical interest rate on a new owner-occupied home loan is around 6.30% p.a., while a new investor home loan comes with a typical rate of around 6.50% p.a. • The RBA’s overnight cash rate target, currently at 4.35%, is a crucial tool in managing the economy, controlling inflation, and ensuring financial stability. • The cash rate can be adjusted to make borrowing more expensive when the economy is overheating and inflation is rising, or to make borrowing cheaper and encourage spending when the economy is sluggish and growth is subdued. • The RBA cash rate impacts home loan interest rates by affecting how banks manage their money, which requires a certain level of liquidity at the end of each day. • When a bank disburses more funds through loans and deposit withdrawals within a single day than it receives in new deposits and loan repayments, the cash rate comes into play, causing the cost of doing business for banks to increase interest rates to recoup their higher costs. • Lenders may adjust their home loan interest rates even if there has been no change in the cash rate, referred to as ‘out of cycle’ home loan rate changes. |

To know more, read the article below.

Home loan interest rates as of June 2024

The RBA cash rate is presently at its highest point in over a decade, and it has significantly influenced home loan interest rates.

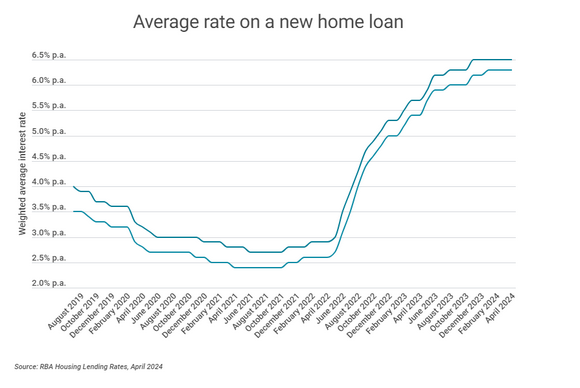

According to the most recent RBA data, the average annual interest rate for a new owner-occupied property loan is approximately 6.30%. In contrast, a new investor property loan typically carries an annual percentage rate of approximately 6.50%.

That is not to suggest that there are no longer competitive home loans available. There are numerous offers available that may be worth considering if you are in the process of purchasing or refinancing a property in the current rate environment.

What is the cash rate of the Reserve Bank of Australia?

If you are currently in the market for a mortgage product or are merely comparing your options, you have likely encountered a discussion about the RBA cash rate.

The cash rate, which is frequently referred to as the overnight cash rate objective by the Reserve Bank of Australia (RBA), has a significant impact on a variety of factors. However, the primary concern of home loan holders is the potential impact on interest rates.

In its most basic form, the RBA cash rate establishes the amount that lenders must pay to borrow money. The daily operations of a bank become more costly as the cash rate increases.

Consequently, the interest rates that banks and lenders charge to debtors and provide to depositors will be high when the cash rate is high. In the end, banks and lenders, like the rest of us, are motivated to safeguard their financial interests.

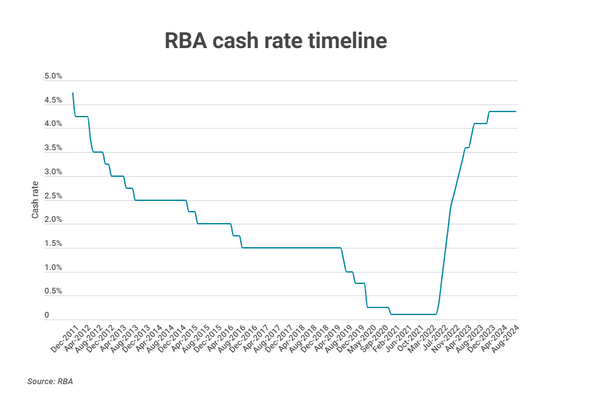

At present, the cash rate is at its highest level since 2011, standing at 4.35%.

The cash rate’s recent fluctuations are illustrated in the chart below:

Why is the cash rate necessary?

The cash rate is an important tool for managing the economy. The Reserve Bank of Australia (RBA) can control inflation, influence economic activity, and maintain financial stability. The RBA may raise the cash rate to make borrowing more expensive when the economy is overheating and inflation (i.e., the price of goods and services) is rising too quickly, which can be expected to cool down investment and spending. Conversely, if growth is muted and the economy is slowing down, a lower cash rate can stimulate growth by lowering borrowing costs and promoting expenditure. In summary, the cash rate is a lever that balances economic growth and maintains a sound financial system.

Why does the RBA cash rate have a huge impact on home loans?

Impact of RBA Cash Rate on Home Loan Interest Rates

- Banks manage their money to maintain liquidity.

- Cash deposits in savings accounts and term deposits contribute to liquidity.

- Funds lent to borrowers reduce liquidity.

- If banks disburse more funds than received, the cash rate comes into play.

- Banks borrow overnight to meet liquidity needs, charged the overnight cash rate set by the RBA.

- High cash rate increases the cost of doing business for banks, leading to increased interest rates.

- Lenders may adjust home loan interest rates ‘out of cycle’, affecting the overall interest rate.

Need more help?

Team of financial experts at ASK Financials are ready to answer your questions. Contact us today for a free consultation.

Call us at: 0433 944 055

or

Book a Free chat: https://tinyurl.com/askfinancials/

To read more articles: https://tinyurl.com/2p9tydsr